- Ethereum consolidation reveals diminished interest from whales as the market struggles with uncertainty.

- Assessing the state of demand as exchange flows drop to 2024 lows.

Ethereum [ETH] has been stuck in a consolidation phase for the last three months. But is there hope for a possible breakout from the consolidation zone in November? Here’s a look at how ETH has been fairing so far.

Ethereum crushed bullish expectations since August after price failed to achieve a substantial recovery, following its crash since May. However, its lower highs since august suggests that significant accumulation has been taking place during the last three months.

Source: TradingView

Despite the higher lows, price has struggled to push above the $2,800 during the last 3 months. This outcome was a reflection of the current state of demand in the market, especially in the whale category.

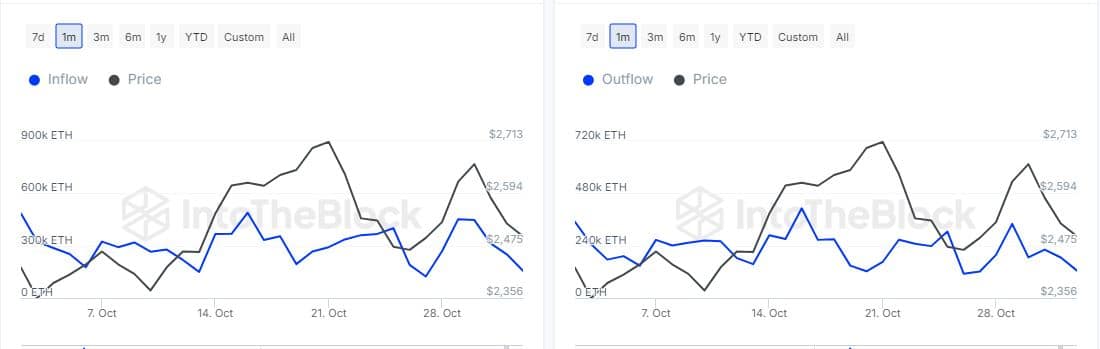

Ethereum large holder flows have been declining since the end of October. However, outflows were notably lower than inflows, which suggests that demand may be about to flip sell pressure.

A major reason for this was because the sell pressure in the last few days pushed for a retest of ETH’s ascending support in the last few days.

Source: IntoTheBlock

The dip in large holder outflows suggests that sell pressure from whales has been declining. This could pave the way for a potential pivot. However, the decline in large holder inflows also indicates less interest from whales.

Is Ethereum demand making a comeback?

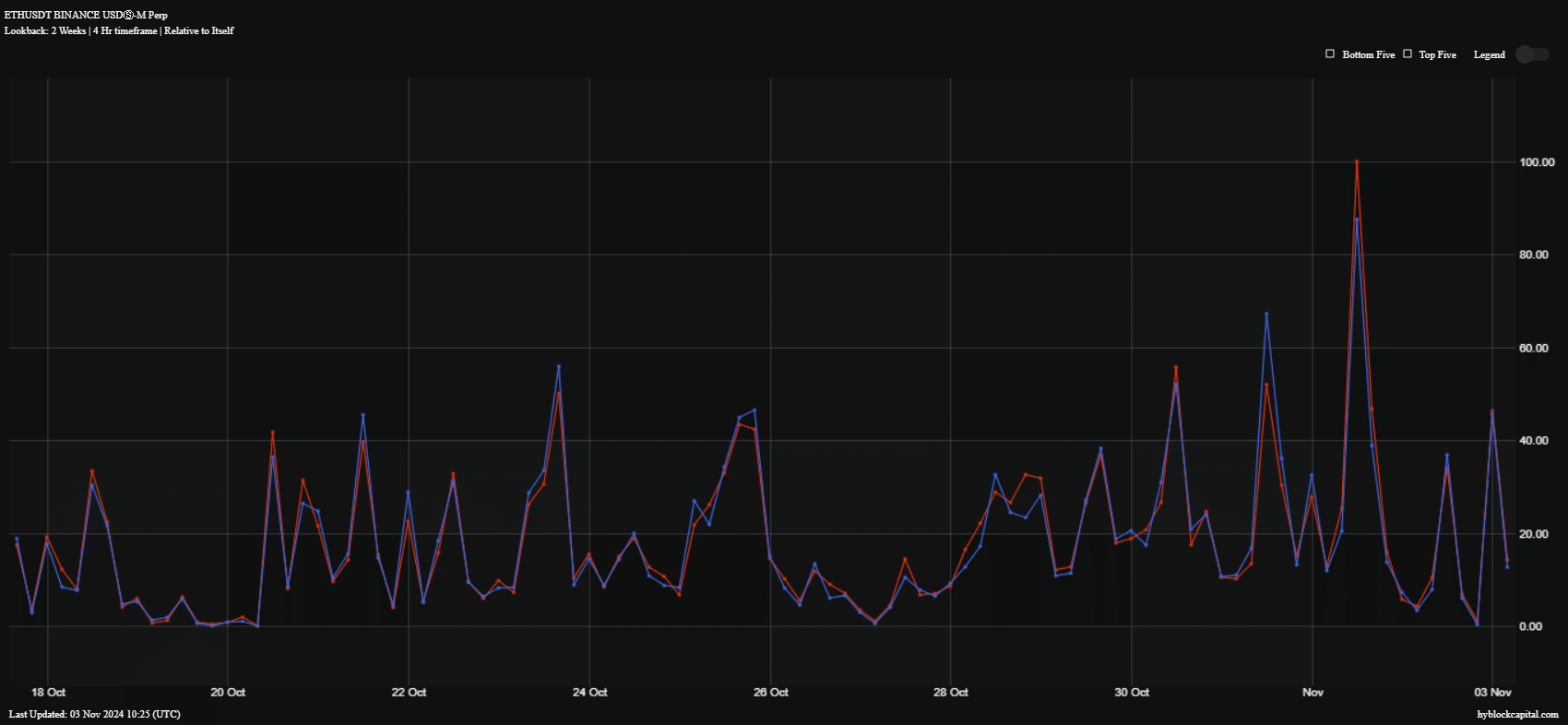

While large holder flows did not necessarily indicate a resurgence of excitement, but buy and sell volume reveals something interesting. Ethereum buy and sell volume registered a massive spike on 1 November, with buy volume dominating.

Source: HyblockCapital

The spike in buy volumes may indicate the possibility of renewed interest in ETH this month, although that was yet to be seen. Part of the reason for this observation could be that investors have been holding back due to uncertainty around the election period.

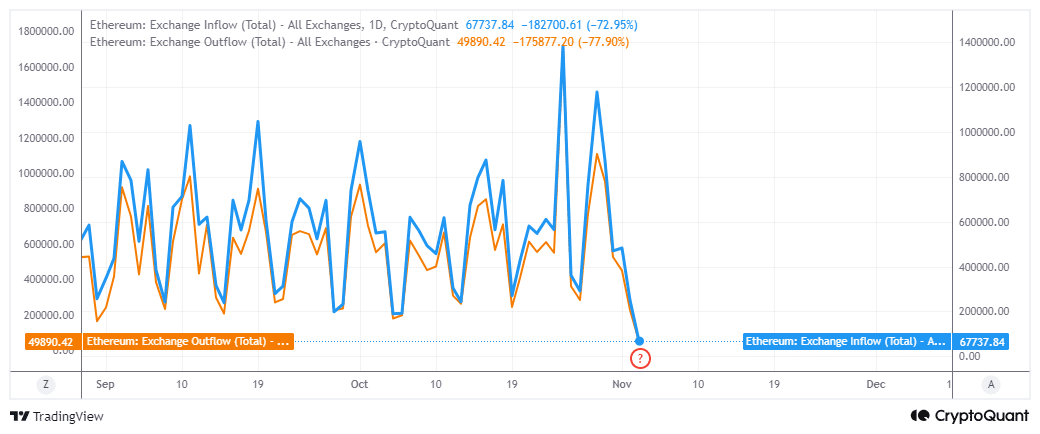

Exchange flows reacted to the current level of uncertainty by dropping to the lowest levels seen so far in 2024.

Source: CryptoQuant

Exchange inflows were notably higher than the level exchange outflows. The latter amounted to 49,890 ETH while the former had 67,737 ETH in the last 24 hours at the time of writing.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Based on all the above observations, it was clear that Ethereum price action was a reflection of dampened investor sentiment. The consolidation however, suggests that we could see renewed interest after the U.S elections.

However, the elections outcome may have a negative or positive impact depending on which candidate will win.

Credit: Source link