- On-chain metrics were used to analyze the state of three AI coins.

- RNDR had a slightly more bullish price action in the past month.

AI cryptos are a promising sector in the crypto ecosystem. The rise of AI through tools such as ChatGPT, Fireflies, Midjourney, SaneBox, and a dozen others aids the automation of everyday tasks at the workplace or with innovation.

Combined with the relatively nascent nature of the AI sector of crypto, it has got denizens wondering if this is the niche to find the next gem.

The top five coins in the AI sector, according to CoinMarketCap, have a combined market capitalization of $21.2 billion. By comparison, the market cap of Dogecoin, the foremost among memecoins, stands at $22.18 billion at press time.

AMBCrypto decided to analyze the on-chain metrics of three of the top five AI cryptos, namely Render [RNDR], The Graph [GRT], and Injective [INJ] to understand holder sentiment and user engagement.

The big question is – Which of these AI coins has the most bullish outlook in the long term?

An introduction to the trio

In the past seven days, Bitcoin [BTC] has gained 8.9%. RNDR has lost 4.9% at press time, while GRT and INJ have rallied 13.9% and 18.1% respectively. This is important because when the market has conviction in an altcoin, it generally has outsized gains compared to Bitcoin.

This does not completely capture the price trends of the three coins in the 1-day timeframe. From a technical analysis perspective, INJ was the weakest among them. Both INJ and GRT have a bearish market structure on the 1-day chart.

Meanwhile, RNDR formed a short-term range below the $11.3 resistance level.

Coming to what the tokens aim to do, Render Network is peer-to-peer and utilizes the blockchain to distribute GPU rendering power. Its goal is to democratize GPU cloud rendering and make it more efficient and scalable.

The Graph is an indexing protocol that allows developers to find and use public data to build decentralized apps. It aims to reduce the costs for developers with its market data and improve server uptime, among other targets.

Injective is a decentralized exchange on the Cosmos blockchain that allows the cross-margin trading, futures, and forex. It is built as a Layer 2 application and uses cross-chain bridges to allow traders to access assets from the Polkadot and Ethereum networks.

Now that we have an idea of what they do, a deeper dive into the metrics of these AI cryptos could be more insightful.

On-chain metrics reflected the price trends to an extent

Source: Santiment

RNDR had a rising trend of daily active addresses in the past three weeks. However, its development activity values were extremely low at 0.048, for comparison Cardano [ADA] logged 94 at press time.

The weighted sentiment was negative and has largely been that way since the 22nd of March. On the other hand, the mean coin age was trending higher to indicate market-wide accumulation.

The MVRV ratio was near zero, indicating slight profits for holders. Overall, accumulation and active users were positive but the development activity was concerning.

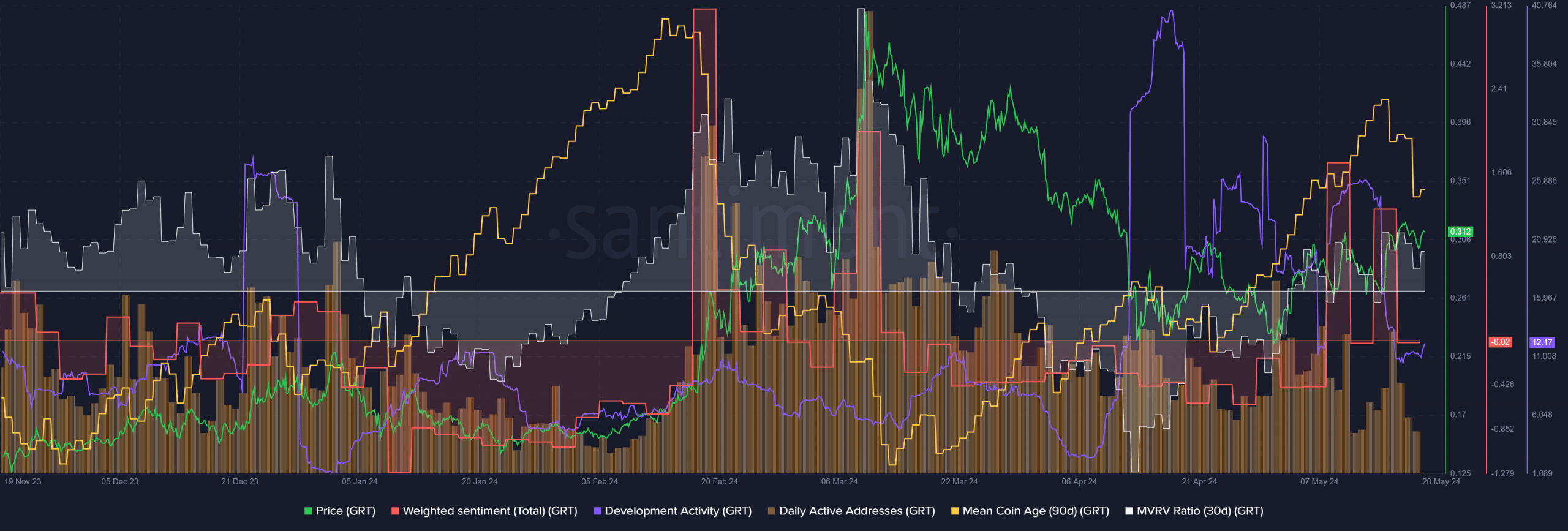

Source: Santiment

GRT witnessed a downtrend in its daily active addresses since early March. On the other hand, its development activity was reasonable at 12.17 at press time, reaching a peak of 39.4 in May.

Weighted sentiment has picked up over the past week but was negative at press time.

GRT also saw an uptrend in the mean coin age and a positive MVRV ratio. This highlighted accumulation and short-term holders in profit and signaled that there was room for more gains.

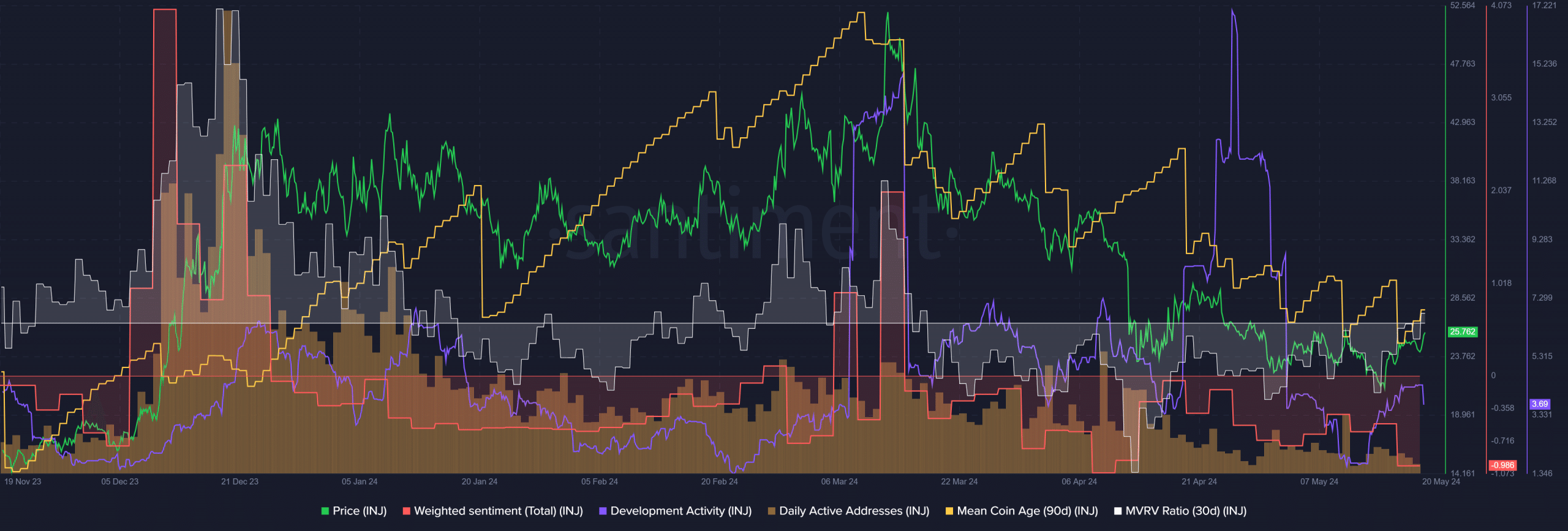

Source: Santiment

Injective, unlike the other two, had a more drastic downward slope to its active users, especially compared to the December peaks. Its development activity was also low at 3.69 at press time, and weighted sentiment was consistently negative.

The mean coin age was also in a steady downtrend and highlighted selling pressure.

Read Render’s [RNDR] Price Prediction 2024-25

In the past three weeks, the price has stabilized above the $20 mark, and its short-term holder profits have increased during the recent rally. Yet, of the three it had the weakest bullish outlook.

With its high daily active users, accumulation trends, and rising prices from the recent lows, Render Network has a good chance of outperforming the other two in the coming weeks.

Credit: Source link