- XRP shows signs of a possible breakout, with analysts predicting a major surge.

- On-chain data reveals declining active addresses, raising questions about the strength of the bullish trend.

Ripple [XRP] was trading at $0.5842 at press time, marking a 1.8% increase and continuing its steady recovery over the past weeks. In the last seven days alone, XRP has risen by 7.3%, sparking optimism among investors and analysts.

This recovery comes amid a period of overall market volatility, where XRP’s performance has been relatively subdued compared to some other major cryptocurrencies.

Analysts point to a 7-year compression pattern

Renowned crypto analyst CrediBull commented on XRP’s recent price movements, highlighting the asset’s long-term compression over nearly seven years.

He described this as “the mother of all bull flags,” emphasizing its uniqueness in the crypto space.

Source: CrediBull on X

CrediBull noted:

“Literally nothing else like it in this space, partly because most of the coins here haven’t even existed for 7 years lol. When the old guard wakes up it’s going to be legendary.”

Another analyst, MoonLambo, expressed a similar sentiment, stating, “As I’ve said many times XRP cannot, and will not, stay in this range against the dollar forever,” indicating his belief that XRP will eventually reach a new all-time high.

XRP’s on-chain and market data: Assessing bullish signs

To gauge whether XRP is truly poised for a bullish surge, looking at its on-chain metrics is considered. Despite the optimistic technical outlook, on-chain data presents a more nuanced picture.

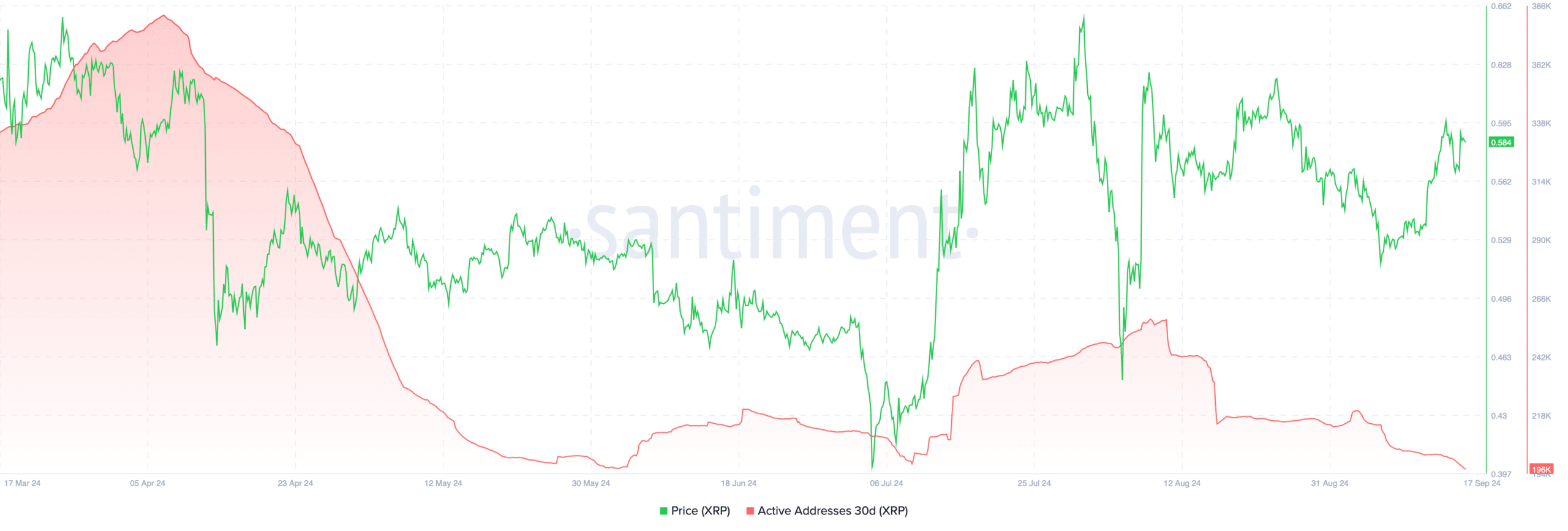

According to Santiment, the number of active XRP addresses has seen a significant decline in recent months.

Source: Santiment

This figure has dropped from a peak of 382,000 in April to around 196,000 currently. A reduction in active addresses often indicates waning user engagement and reduced transaction activity on the network.

This decline could signal caution for the immediate future, as lower active addresses may limit the upward momentum and suggest that the rally could be short-lived without a renewed influx of participants.

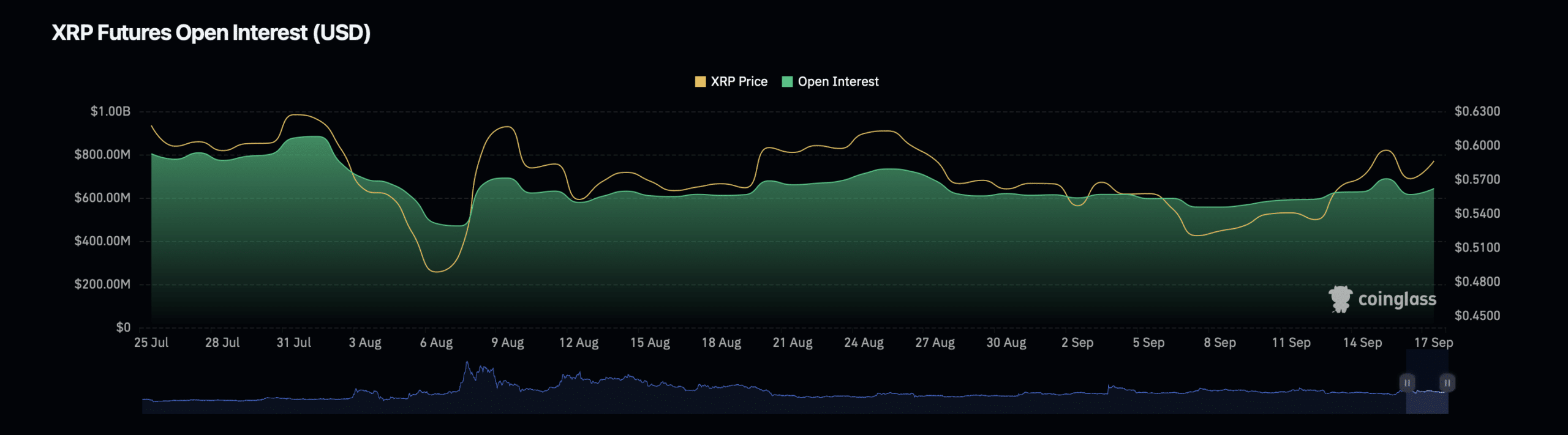

Further data from Coinglass revealed XRP’s open interest has risen by 4.32%, reaching a current valuation of $650.26 million. Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled.

Source: Coinglass

An increase in open interest suggests heightened trading activity, reflecting growing speculation on XRP’s price direction. Additionally, the asset’s trading volume has experienced a slight uptick of 0.15%, amounting to $1.32 billion.

Read XRP’s Price Prediction 2024–2025

A simultaneous increase in both open interest and volume could indicate a strengthening trend, where traders are taking positions in anticipation of a potential price movement.

However, it also introduces the possibility of increased volatility, as higher open interest can lead to sharp market reactions to news or price fluctuations.

Credit: Source link