Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

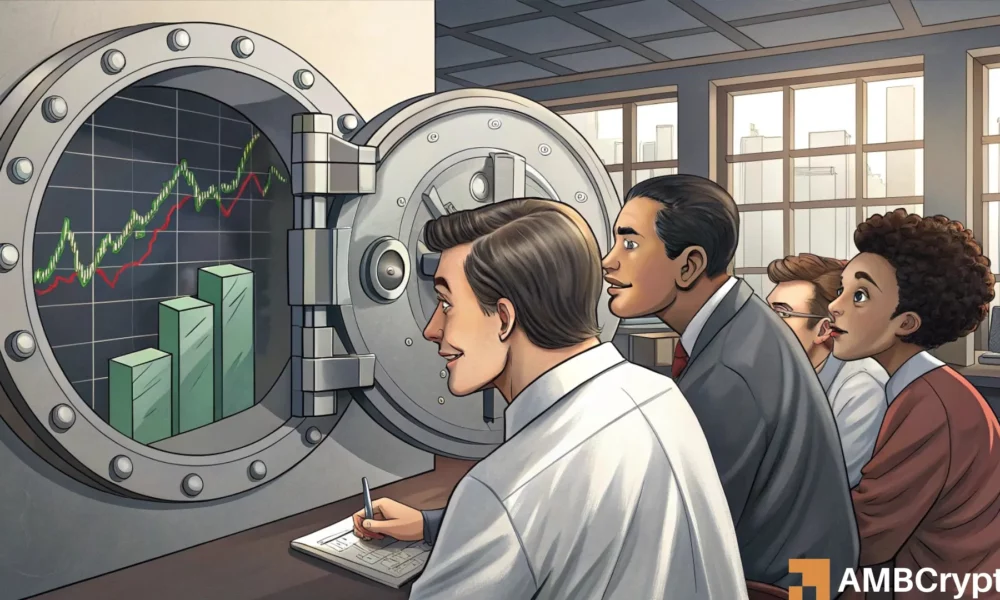

- The futures market showed strong bearish sentiment in recent days

- The price action of ARB favored the sellers too, and Fibonacci levels highlighted key support levels

Arbitrum saw the launch of the native USDC last week. Previously users could only access the bridged version of the stablecoin. Users of the platform were bullish on the development as it would spur increased usage and a more robust ecosystem. The platform experienced increased cash flow in recent months as well.

Read Arbitrum’s [ARB] Price Prediction 2023-24

Yet, this news did not halt the downtrend of ARB on the price charts. The sentiment across the market was fearful and dominated by the sellers over the past two weeks. Can traders look to short the token?

The downtrend showed signs of reversal in late May but…

Source: ARB/USDT on TradingView

In late May, Bitcoin [BTC] climbed past the $27k mark. Ethereum [ETH] also edged toward the $2000 level, although it was halted just above $1900. When the prices of BTC and ETH were trending upward, Arbitrum bulls found it easier to push prices higher.

Yet, with the On-Balance Volume (OBV), we see that a true uptrend was not established. The trading volume in the last week of May was also relatively low. This suggested that a strong trend was not in progress. Hindsight is 20/20 but the daily market structure also flipped bearish in June, showing just how important volume and demand are to establish trends.

The Relative Strength Index (RSI) showed strong bearish momentum and the OBV underlined steady selling pressure. The Fibonacci levels (pale yellow) showed that the next targets are $0.82 and $0.51, which are the 23.6% and 61.8% extension levels.

In particular, the $0.51 target could be extremely ambitious- but the lack of demand and intense bearish sentiment across the market could see such a move materialize.

The funding rates highlighted the gloom as ARB prices slipped below $1

![Arbitrum [ARB] falls below $1, but should bears look to short it?](https://statics.ambcrypto.com/wp-content/uploads/2023/06/PP-3-ARB-coinalyze.png)

Source: Coinalyze

At the time of writing, the funding rate was just above the zero level. It had dropped deep into the negative territory on 11 June, when ARB prices dived beneath the $1.05-$1 zone. Yet, the prices halted there and the OI began to flatten as well.

Is your portfolio green? Check the Arbitrum Profit Calculator

This suggested that the majority of the market was not entering short positions but the environment did not favor small long positions (larger ones can collect more in funding fees). The spot CVD was in a consistent downtrend, like the OBV. Overall, the sentiment in the market remained in bearish control.

Credit: Source link

![Arbitrum [ARB] falls below $1, but should bears look to short it?](https://statics.ambcrypto.com/wp-content/uploads/2023/06/PP-3-cover-7-1000x600.jpg)