AVAX has been expanding its reach in various areas over the past few months, but one aspect that has seen tremendous growth is its smart contract deployment.

With this significant milestone, many investors and traders alike are speculating whether this development could be the catalyst that propels the Avalanche Network native token’s price to new heights.

Will this newfound growth in smart contracts lead to a surge in AVAX’s value?

Contract Deployment Spike Could Boost AVAX Adoption

According to the latest CoinMarketCap data, Avalanche (AVAX) has experienced a minor 2.04% dip in its price over the last 24 hours, but still remains relatively steady at $17.04.

Despite this slight setback, data from Artemis reveals that the network has witnessed a significant spike in contract deployment, which can be a positive indicator for the protocol’s usage and adoption.

The contract deployment of $AVAX has recently hit its highest levels in over six months.

After analyzing the on-chain activity, we found that contract deployment hasn’t seen such growth since May 2022. pic.twitter.com/ehkVk7ZrrK

— Artemis 🏹 (@Artemis__xyz) April 28, 2023

The increase in the number of smart contracts deployed on the Avalanche network suggests that more developers are building dApps and exploring the potential of the platform.

As the number of dApps on the network grows, it can lead to a wider range of use cases for the protocol, attracting more users and projects. This increased adoption and usage can ultimately drive up demand for AVAX.

If the trend of contract deployment continues to rise, it could be a sign of a healthy and growing ecosystem on Avalanche. This, in turn, can further boost the token’s value.

Avalanche Network TVL. Image: Defillama

Avalanche’s DeFi Performance Disappoints

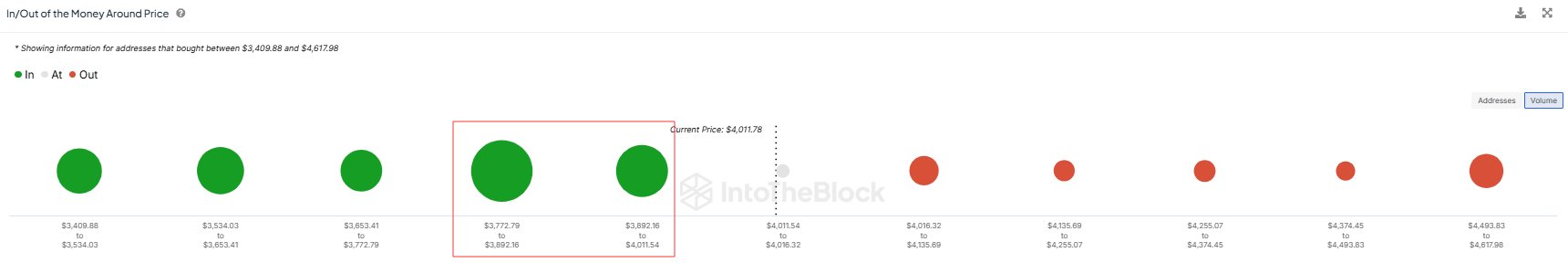

Despite a significant increase in smart contract deployment on the Avalanche network, the platform’s performance in the decentralized finance (DeFi) sector has been less than stellar.

Recent data shows a sharp decline in the platform’s decentralized exchange (DEX) volume, falling from 311 million to 13.74 million in just a few months. This has had a direct impact on Avalanche’s total value locked (TVL), which has also seen a decline.

One of the contributing factors to the decline in Avalanche’s DeFi performance has been the decreasing interest in BTC.b, a wrapped Bitcoin token on the network used for DeFi purposes.

According to data from Dune Analytics, all DEXes on the Avalanche network have witnessed a decline in BTC.b usage, indicating a lack of interest in the platform’s DeFi offerings.

AVAX total market cap at $5.5 billion on the daily chart at TradingView.com

Outlook For AVAX

Despite the disappointing DeFi performance, the increase in smart contract deployment on the Avalanche network remains a positive indicator for the platform’s future prospects.

As more developers build dApps and explore the network’s potential, it can lead to a wider range of use cases and attract more users and projects.

-Featured image from Analytics Insight

Credit: Source link