Things could worsen for BlockFi users as a United States judge rules against a petition to recover over $300 million in Bitcoin. The failed crypto company filed for bankruptcy in late 2022 following a widespread collapse of lenders in the sector.

As in most cases, when a company undergoes bankruptcy, users are the most affected. Per a Bloomberg report, some BlockFi users have been denied access to the possibility of recovering their funds as they unintentionally forfeit their right over the crypto held on the lending platform.

Poor Communications Affect BlockFi Users’

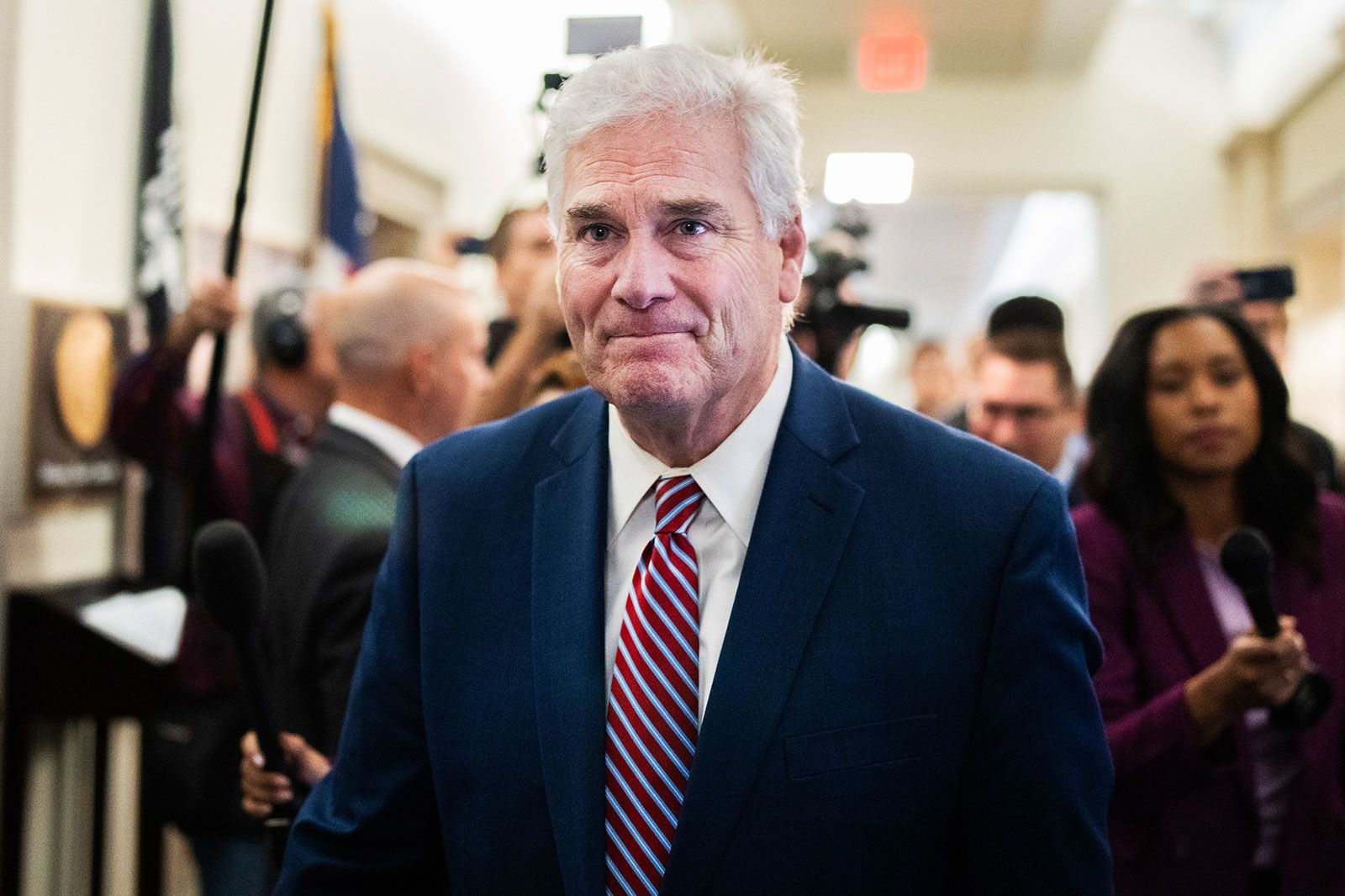

The decision was ruled by U.S. Bankruptcy Judge Michael Kaplan, according to the report. The judge dismissed BlockFi customers’ arguments if they held coins earning interest on the platform. In this case, these users gave up the rights to their assets.

The decision, while controversial, has been standard in similar legal cases. In 2022, the crypto industry saw major lenders collapse as the price of Bitcoin and the market trended to the downside.

The “Crypto Winter” worsened when crypto exchange FTX, owner of BlockFi and other lenders, followed the trend and filed for Chapter 11 bankruptcy. In this context, U.S. judges have been siding with the failed crypto companies when determining if users with interest-bearing accounts retain ownership of their coins.

For BlockFi users circumstances were harsher, the company underwent a series of potential acquisitions but eventually was forced to declare bankruptcy. The critical argument behind Kaplan’s decision was communication between the crypto lender and its users.

In late 2022, when rumors about BlockFi’s collapse began circulating, some of these users tried to take out their coins from the platform. The company notified them that the withdrawal transactions were completed, but this information was false.

U.S. Bankruptcy Judge Kaplan stated, according to Bloomberg:

The user interface did not accurately reflect the transactions.

However, not everything is lost for these individuals. Users with coins on custodial accounts, not receiving any yield from their crypto, can benefit from the $300 million in assets stock on the crypto lending platform and could recover a portion of their funds.

Credit: Source link