The price of Bitcoin (BTC) is showing signs of gaining momentum as it approaches the highly anticipated release of the US Nonfarm Payroll data.

Investors and traders are closely monitoring this economic indicator, which is expected to impact the market significantly.

The recent surge in Bitcoin’s price suggests growing optimism among market participants, who anticipate positive outcomes from the upcoming release.

In this Bitcoin price prediction, we will delve into the current state of Bitcoin’s price and explore the factors contributing to its upward momentum, highlighting the potential implications of the US Nonfarm Payroll data on the cryptocurrency market.

US NFP Ahead; Potential Impact on Bitcoin

The upcoming release of the May Non-Farm Payroll Report has caught the cryptocurrency market’s attention. The Bureau of Labor Statistics has forecasted fewer jobs added than the previous month, which could have implications for the US dollar and, in turn, Bitcoin.

If the actual number exceeds the forecast, it could positively impact the US dollar, leading to downward pressure on Bitcoin’s value due to its indirect relationship.

The market is also eagerly awaiting the release of the Unemployment Rate and Average Hourly Rate for May, as these factors will further influence the value of the US dollar.

Traders are cautious ahead of the Non-Farm Payrolls data, with the US Dollar Index showing a slight decline in the past 24 hours.

CleanSpark Expands BTC Mining Production Amidst Declining Profitability

CleanSpark, a cryptocurrency mining firm, has aggressively expanded its collection of mining machines this year.

Despite an overall decline of 44% in mining profitability over the past year, mining companies continue to build and increase their production.

CleanSpark, an American Bitcoin mining company, recently made headlines by purchasing 12,500 new Antminer S19 XP units for approximately $40.5 million.

This acquisition was made at a price below the market average.

The timing of this announcement coincides with Bitcoin mining difficulty reaching an all-time high of over 50T, adding further pressure on BTC miners who are already grappling with the increased use of AI in mining operations.

CleanSpark’s expansion efforts, despite reduced mining profitability, underscore the company’s commitment to Bitcoin mining.

The news of this expansion provided a modest boost to BTC prices during the early trading hours of Friday’s session.

US Commodities Agency Could Modify Risk Guidelines to Take Crypto

The risk management program of the agency is under review. Commissioner Romero highlighted the high-risk nature of advanced technologies such as AI, cloud services, and digital assets.

In response, Commissioner Christy Goldsmith Romero proposed modifications requiring companies to be prepared for crypto volatility and the associated risks of holding clients’ digital assets.

The US Commodity Futures Trading Commission (CFTC) is considering revisions to its risk management regulations in light of these concerns.

According to Goldsmith Romero, the commission needs to review its regulatory oversight, particularly its risk management criteria, considering the risks associated with technological advancements.

Integrating digital assets with banks and brokers may pose changing dangers in the future.

The speaker also addressed ongoing issues with the industry’s custody procedures, highlighting the potential risks of brokers holding customer property in stablecoins or other digital assets, which could introduce unknown and unique risks.

Bitcoin Price Prediction

During the Asian session on Friday, Bitcoin showed signs of bullish momentum as it bounced back from the 26,620 level.

This aligns with our previous prediction for Bitcoin’s price movement, as we anticipated this scenario in our recent forecast.

Looking at the 2-hour timeframe, we can see hammer candlesticks forming near the 26,620 level, suggesting a decrease in bearish sentiment and a potential opportunity for buying Bitcoin.

On the upside, Bitcoin is likely to face resistance around the 27,275 level, which also corresponds to the 61.8% Fibonacci retracement level that previously acted as a support level.

The 27,275 level is expected to act as a significant resistance level, potentially hindering further upward movement for Bitcoin.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators have crossed into the buying zone, suggesting a high likelihood of sustained upward momentum, particularly on shorter timeframes.

It is worth noting that there is a downtrend line on the daily timeframe, which may limit Bitcoin’s ascent around the 27,275 level.

A decisive breakthrough above this trend line could pave the way for further gains toward the 27,499 level, with the next notable target being $28,000.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Cryptonews Industry Talk presents an intriguing lineup of cryptocurrencies poised for a promising journey in 2023.

Get ready to explore the exciting possibilities that lie ahead for these digital currencies.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

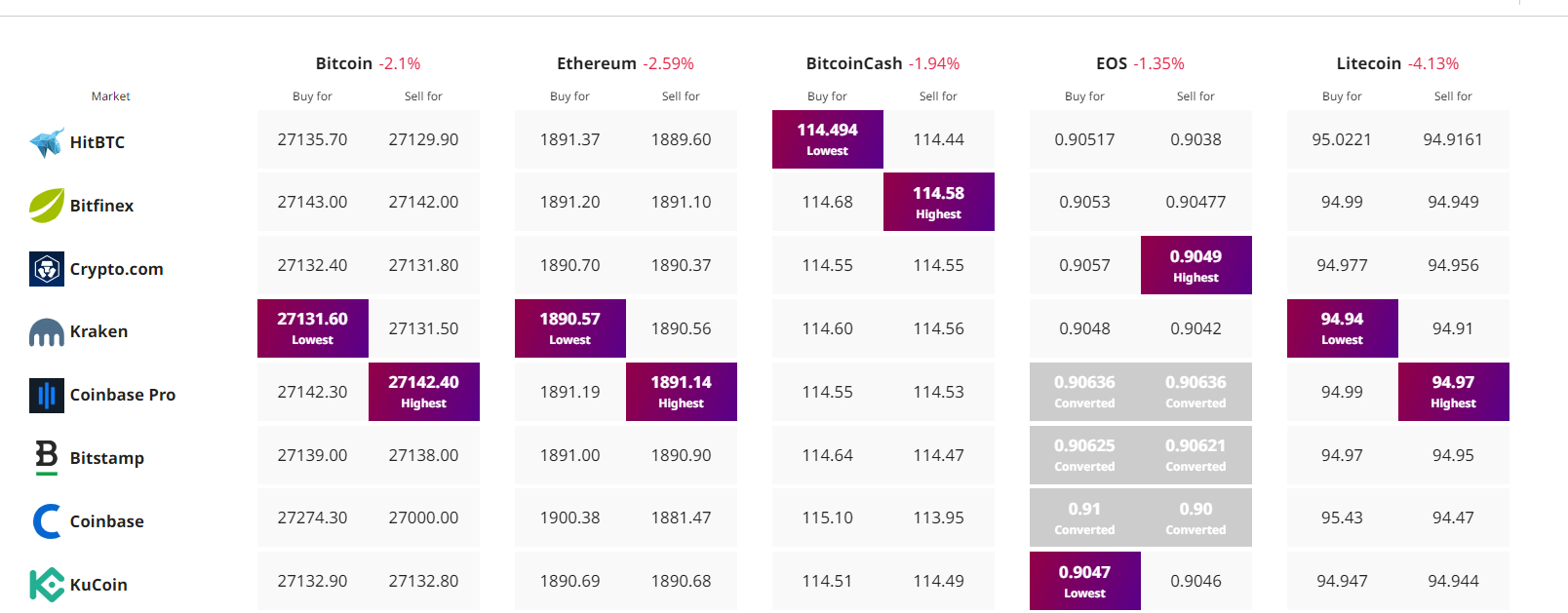

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link