- XRP did not see a large wave of selling on-chain.

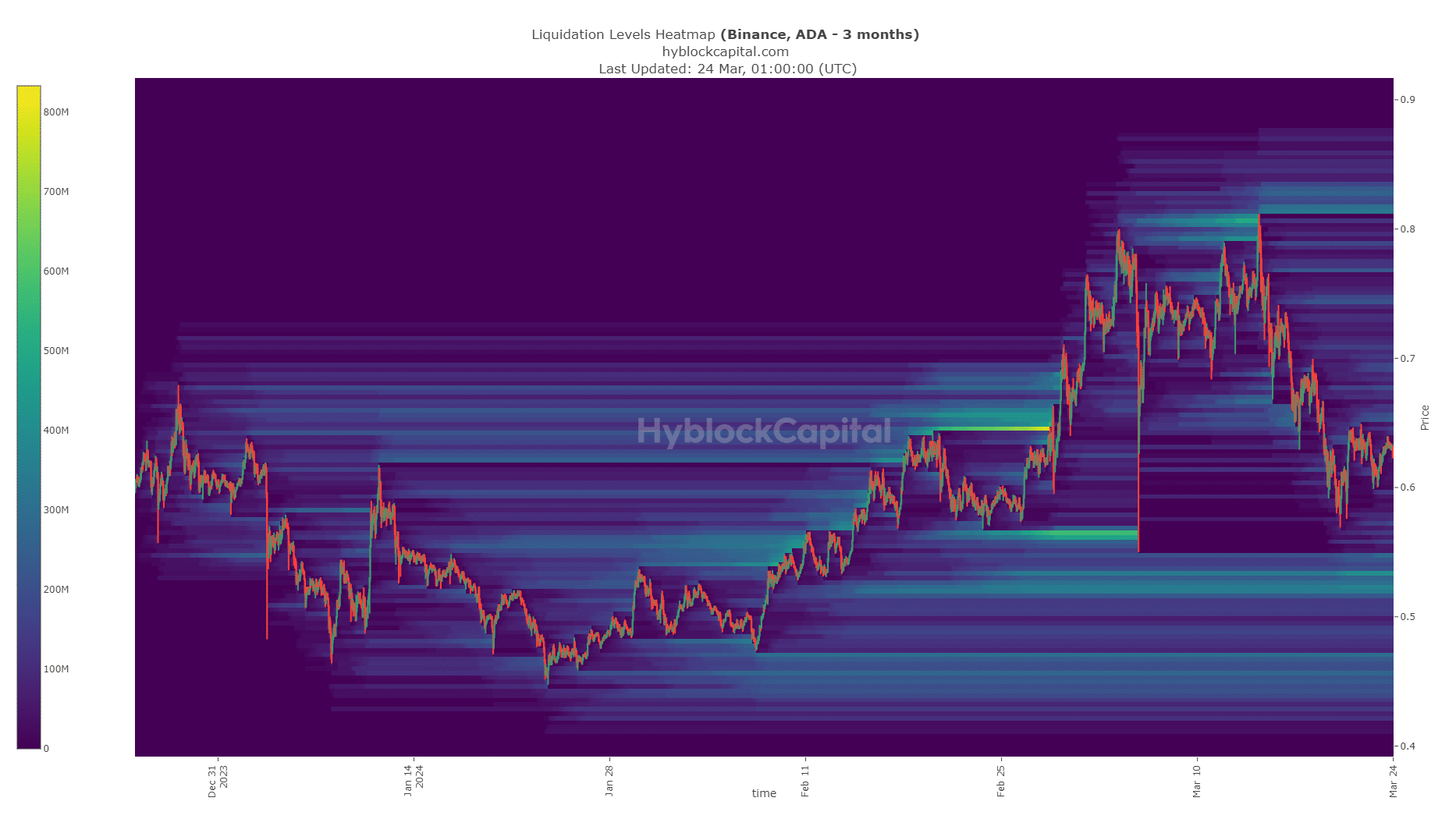

- Cardano reflected bearish momentum on the one-day chart that could force prices lower.

Cardano [ADA] has a bullish on-chain outlook with strongly positive metrics such as development activity and active wallets. Ripple [XRP] also showed accumulation across the network.

Yet, in the past two weeks, sentiment across the crypto market has been muted. The strength of the bulls was curtailed by Bitcoin’s [BTC] pullback. Should investors load up on the dip?

ADA bulls to undergo more turmoil

Source: ADA/USDT on TradingView

The 4-hour bearish order block was briefly flipped to support in the first half of March. Unfortunately for the bulls, they couldn’t hold on.

At press time, the market structure of Cardano remains bullish on the 1-day chart.

Yet, the RSI was below neutral 50 to highlight downward momentum was building up. The OBV was retesting the December highs as support.

If it could hold on, it would be a good sign that the long-term bias was bullish.

A move to the 61.8%-78.6% retracement levels at $0.586-$0.523 is anticipated. The $0.567 level has served as support for a month, and liquidity has built up underneath it.

Source: Hyblock

The liquidation heatmap showed that the $0.57-$0.574 was only a minor area of interest. The $0.52-$0.54 area had a greater number of liquidation levels.

Hence, it was more likely that further drops in Cardano prices could see a visit to this support zone.

The confluence of the price action and the liquidation heatmap supported the idea that further losses could arrive, but that a recovery was likely thereafter.

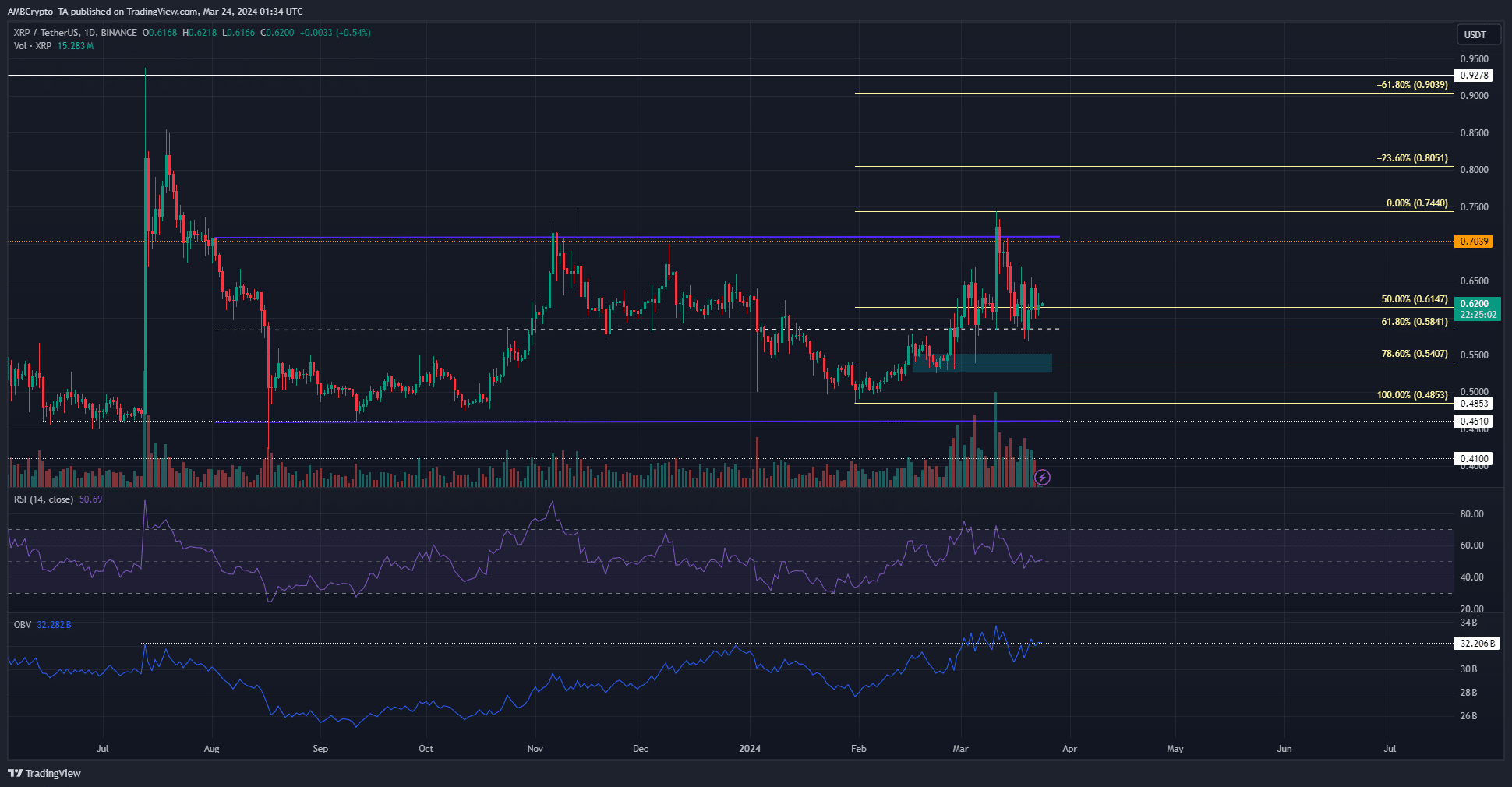

XRP sees accumulation but further losses remain likely

Source: XRP/USDT on TradingView

XRP has been stuck within a range since August 2023. This range extended from $0.46 to $0.7. Over the past three weeks, the price has tested the mid-point at $0.58 as support.

The Fibonacci levels showed that a move to the $0.54 level was possible.

Such a retracement would offer a good buying opportunity. During the rally in February, XRP prices consolidated at the $0.527-$0.552 region, marking it as a demand zone in the scenario of a retest.

The OBV struggled to breach the highs formed back in July 2023. This tied in well with the range formation that XRP has been stuck within for eight months.

The RSI also showed momentum was neutral over the past week.

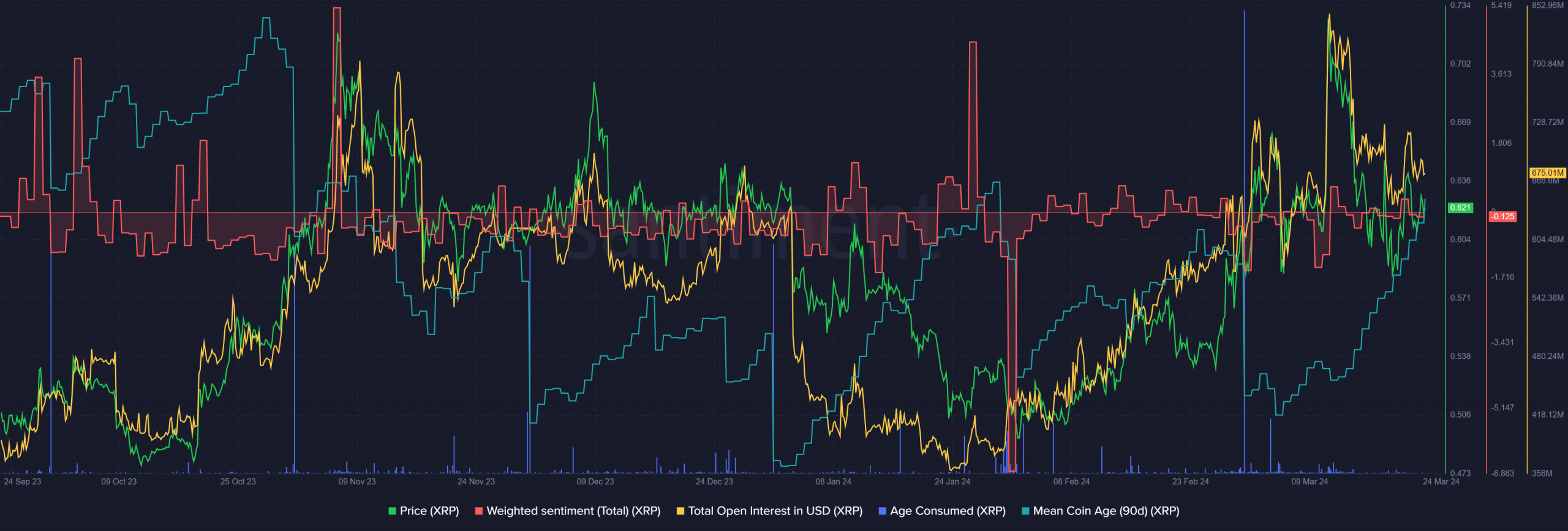

Source: Santiment

The Weighted Sentiment of XRP was slightly negative at press time. It has not been consistently positive for more than a day in the past month.

Also, the Open Interest on XRP contracts has trended downward alongside the price in the past ten days, indicating that bullish conviction has weakened by a large amount.

Despite this, the age-consumed metric has been relatively quiet, meaning that large XRP token movements were not seen recently.

Is your portfolio green? Check out the ADA Profit Calculator

So, a wave of selling pressure might not materialize as holders choose to wait for the trend to shift instead of panicking. This was also reflected in the mean coin age.

The mean coin age metric trended upward in March, even as prices faced formidable resistance at the $0.7 mark. This was a sign of accumulation across the network.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Credit: Source link