Este artículo también está disponible en español.

The Dogecoin price recover came as a welcome sight to investors after the meme coin struggled around $0.09 for a while. Naturally, the move in the price has prompted movement among Dogecoin investors and the whales are not left out of this. As the price rebounds, these whales have increased their activity, moving billions of DOGE to and from their wallets. However, the net flow of these whale wallets paint a bearish story for the DOGE price.

Dogecoin Whales Move Over $500 Million

The large whale transactions tracked by the IntoTheBlock platform are transactions carrying $100,000 or more. These large transactions, although seeing a drawdown from the previous week’s figures, have maintained a reasonably high level. Over the last two days, the average number of whale transactions have come out to 800, showing that interest from the whales remain high.

Related Reading

While the whale transaction numbers actually saw a decrease between Sunday and Monday, going from 899 transactions to 818 transactions, the number of DOGE moved tell a different story. IntoTheBlock’s data shows that 5.19 billion DOGE were moved on Monday compared to 4.59 billion DOGE on Sunday.

In dollar terms, this translates to $522.89 million compared to $499.99 million. Nevertheless, these numbers show an average of $500 million being moved by these whales everyday. As the Dogecoin price continues to recover, the whale transactions could balloon from here as investors move to secure their positions.

Where Are The Coins Headed?

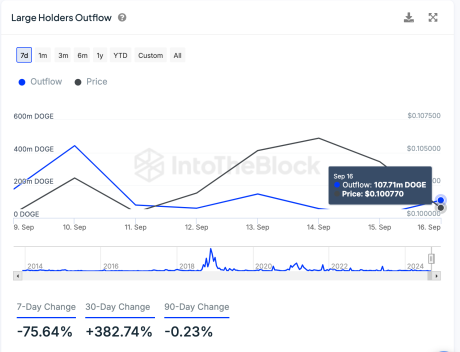

The net flow data for the large whale wallets can tell us where the whales are moving their DOGE coins. This data tracks the inflow and outflows from the Dogecoin whale wallets, meaning how much is entering the wallets and how many coins are leaving. As a result, it can show if these whales are buying or selling at this time.

According to the IntoTheBlock data, the inflows into the wallets have declined, while the outflows from these large wallets have risen over the last few days. Inflows dropped from 37.4 million DOGE on Sunday to only 115.11 million DOGE on Monday. This shows that the Dogecoin whales have not been buying as much DOGE during this time.

Related Reading

In the same vein, outflows also surged from 18.37 million DOGE on Sunday to 107.71 million DOGE on Monday. This outflow trend suggests that Dogecoin whales are selling rather than buying. It explains the selling pressure on the coin over the last few days, making it hard to reclaim $0.1. However, net flow data, which shows the average of inflows and outflows, has remained almost flat.

Nevertheless, the majority of Dogecoin holders look to be in it for the long term as 3.93 million addresses have held their DOGE coins for more than one year. 2.2 million addresses have been holding for between 1 and 12 months. This leaves only 113,660 addresses that have been holding for less than one month.

Featured image created with Dall.E, chart from Tradingview.com

Credit: Source link