Hong Kong has taken another major step towards becoming a leading hub for cryptocurrency and blockchain technology.

The Hong Kong Government has announced the establishment of a task force, known as the Web3 Development Task Force, dedicated to promoting the growth of Web3, with a particular focus on ethical development, according to a recent statement.

The task force is comprised of 15 industry participants and 11 key government officials, including Hong Kong’s financial secretary, Paul Chan.

In addition, there are 15 non-official members, which include industry experts. The task force will have a two-year period to carry out its work.

“The Financial Secretary has announced in the 2023-24 Budget the establishment of the Task Force to provide recommendations on the sustainable and responsible development of Web3 in Hong Kong,” the announcement read.

Chan has been a strong advocate for cryptocurrency and blockchain technology, claiming that Hong Kong needs to seize the “golden opportunity” that Web3 presents.

“Hong Kong seeks to lead and drive innovative exploration and development, create more new application models, and strives to draw together top-notch companies and talent in the arena to build a thriving ecosystem,” he said.

“With the Task Force bringing together leaders and professionals in the sectors involved, I believe their valuable advice will help Hong Kong develop into a Web3 hub.”

Hong Kong’s Web3 Push Starts to Pay Off

It seems that the market has responded positively to the Hong Kong government’s attempts to make the region a global crypto hub.

In fact, over 80 virtual asset-related companies have expressed interest in establishing their presence in Hong Kong since the state released its policy statement on virtual assets in October 2022.

The Hong Kong Government has been actively promoting the region as an attractive destination for cryptocurrency companies.

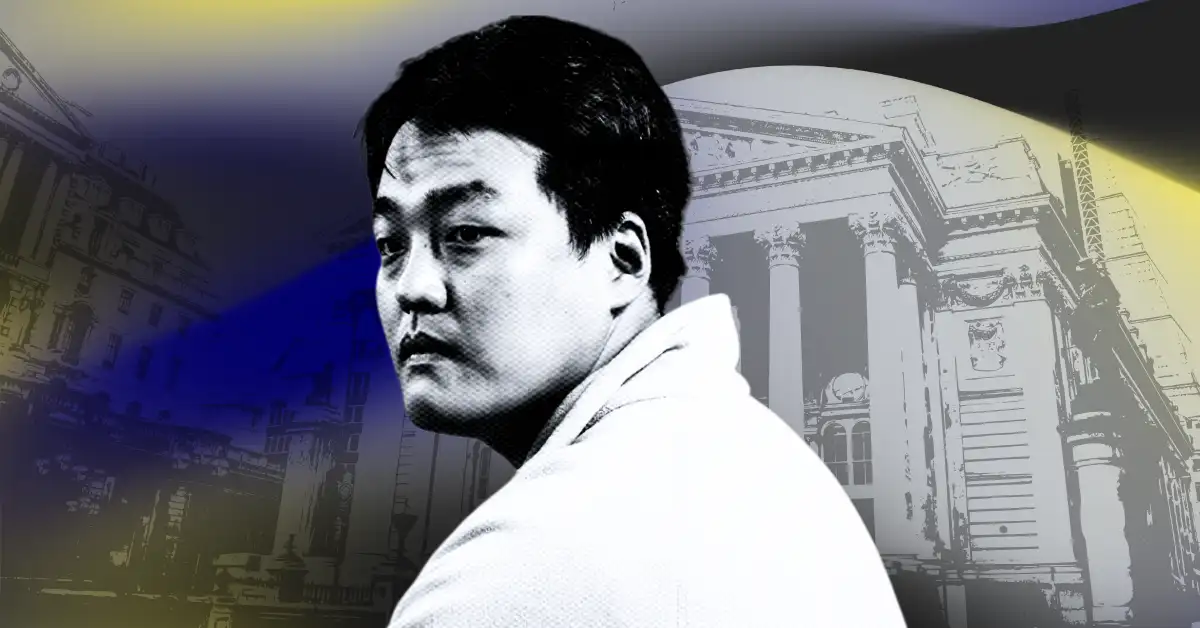

Just recently, Johnny Ng, a Hong Kong Legislative Council member, invited global virtual asset trading platforms to come to Hong Kong and apply for a virtual asset service provider license.

“I hereby offer an invitation to welcome all global virtual asset trading operators including Coinbase to come to HK for application of official trading platforms and further development plans,” he said in a June 10 tweet.

This invitation came shortly after the United States Securities and Exchange Commission took legal action against Coinbase.

Hong Kong also implemented its new regulatory framework for crypto last month.

The new rulebook allows retail investors the ability to trade virtual assets, instead of restricting digital assets trading to professional investors and traders with at least $1 million in bankable assets.

The Securities and Futures Commission (SFC) of Hong Kong will also start providing licenses to crypto exchanges.

The improving regulatory environment in Hong Kong has already caught the attention of some of the biggest crypto companies.

Last week, US-based stablecoin issuer Circle said it is closely monitoring Hong Kong’s crypto policies.

“What’s happening in Hong Kong may be a proxy for ultimately how these markets grow in Greater China,” Circle CEO Jeremy Allaire said.

“We see enormous demand for digital dollars in emerging markets and Asia is really center of that.”

Credit: Source link