- Ethereum continued to trade in the $3,000 price zone.

- However, the ETH/BTC pair broke support for the first time since 2016.

Ethereum’s [ETH] ongoing struggle against Bitcoin [BTC] continues to dominate market discussions, as its ETH/BTC pair remains in a precarious position.

Recent data revealed that Ethereum’s native token, ETH, was hovering around critical support levels against Bitcoin, while staking trends showed continuous inflow.

Here’s what the charts tell us about Ethereum’s trajectory and market health.

Ethereum testing key resistance

Ethereum’s ETH/BTC pair has experienced a modest recovery from its recent dip, trading at 0.03469 BTC at the time of writing.

This followed a significant decline that saw ETH breach the 50-day and 200-day moving averages earlier this year, solidifying a bearish crossover.

The recent uptick, however, has brought it back above 0.034, but the 200-day MA, at 0.0459 BTC at press time, loomed as a formidable resistance level.

Source: TradingView

Indicators such as the MACD showed a bearish trend, with the signal line still below zero, while the Stochastic RSI pointed to oversold conditions, hinting at potential relief rallies.

The OBV (On-Balance Volume) suggested muted momentum, further reinforcing the notion that ETH has been facing significant challenges in reclaiming dominance against Bitcoin.

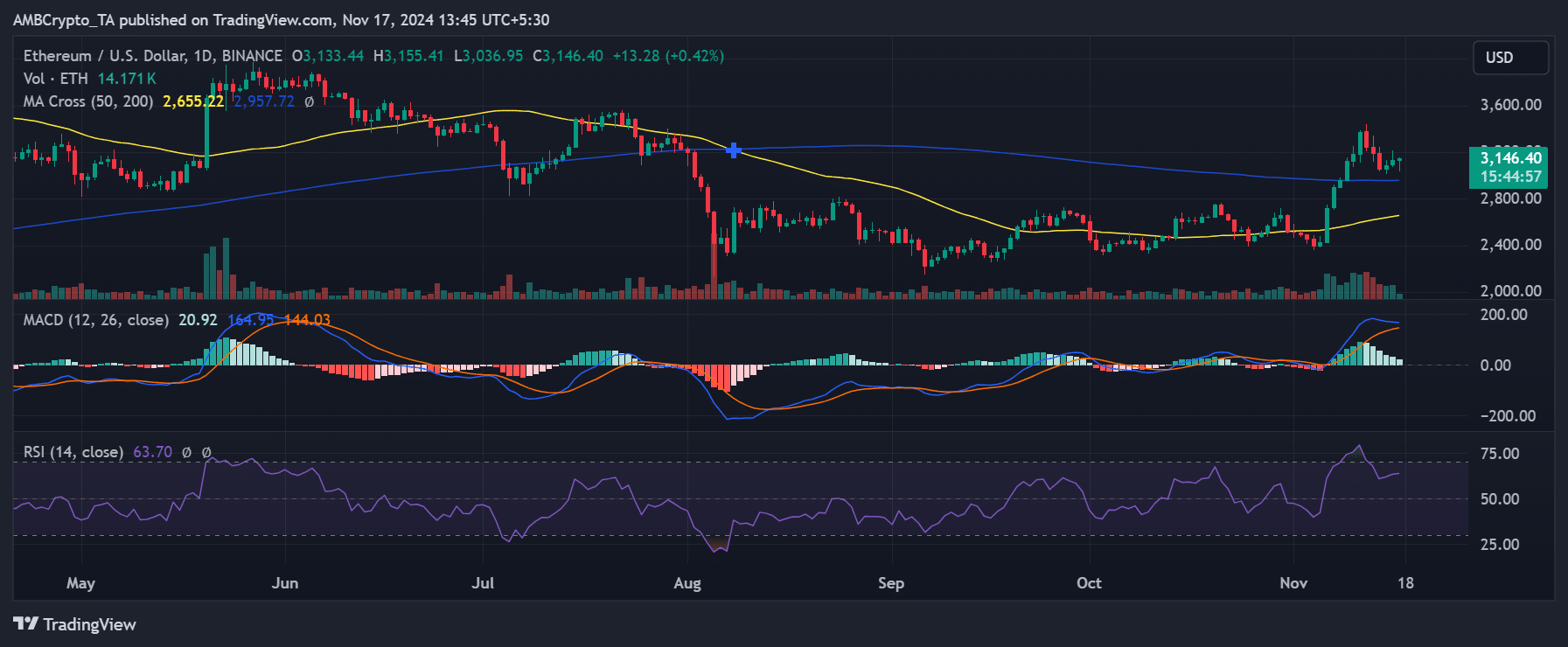

ETH/USD trend: Bullish momentum

In contrast to its struggles against Bitcoin, ETH/USD painted a more optimistic picture. Ethereum was trading at $3,147 at press time, having reclaimed the 200-day moving average at $2,955.

The recent bullish crossover between the 50-day and 200-day MAs signaled a potential shift in momentum, with key resistance levels around $3,200 being closely watched.

The RSI hovered near 71, indicating slightly overbought conditions, while the MACD remained in bullish territory, suggesting room for further upside.

Ethereum’s ability to hold above $3,000 will be crucial in maintaining its upward trajectory in the coming weeks.

Source: TradingView

Ethereum’s TVL remains bright

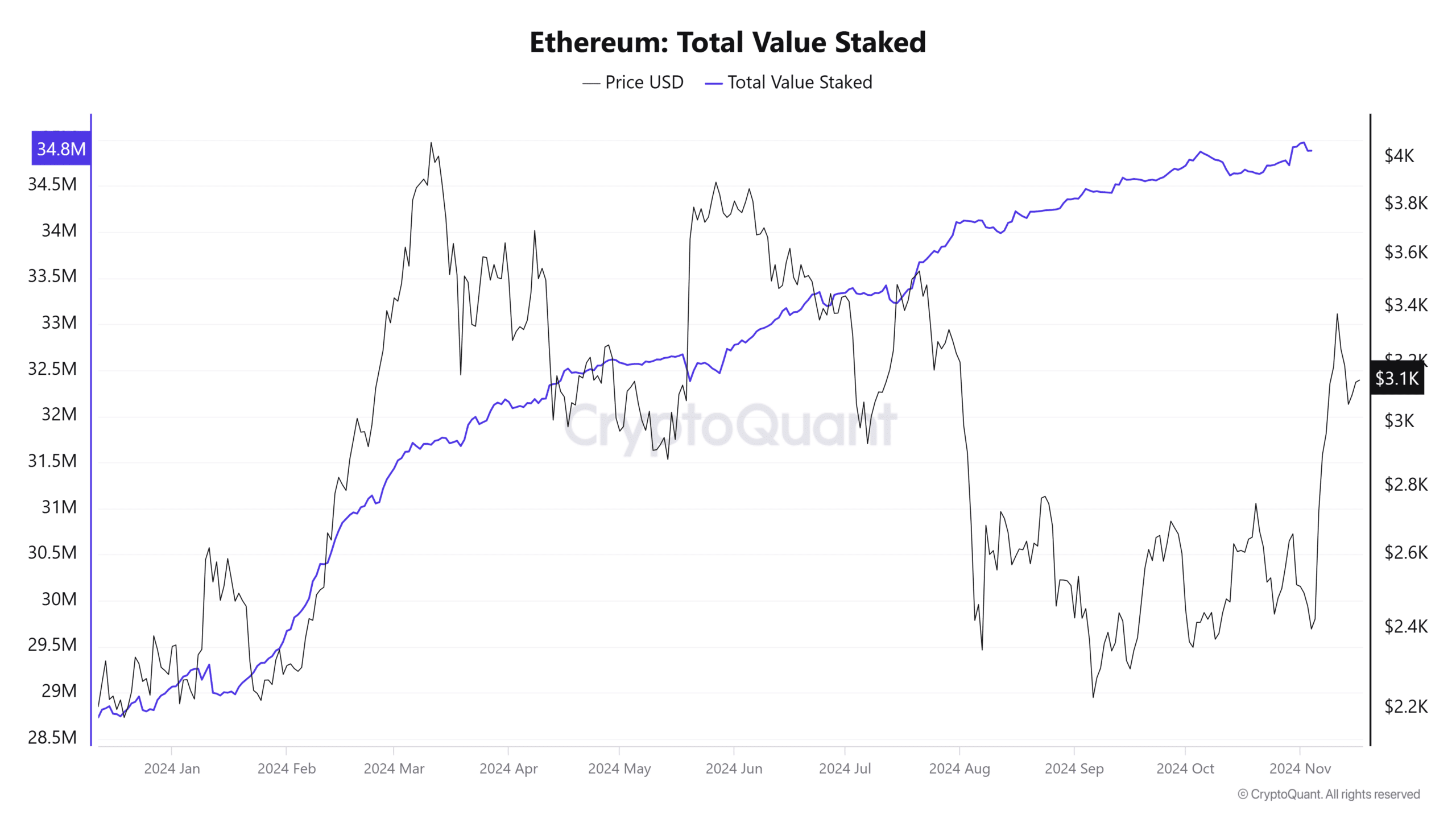

On the staking front, Ethereum’s fundamentals remained robust. The total value staked in Ethereum’s network has hit an all-time high of 34.8 million ETH, underscoring strong confidence among holders.

This metric, paired with Ethereum’s press time price of $3,100, highlighted a steady increase in staking participation despite the lackluster performance against Bitcoin.

Source: CryptoQuant

The chart from CryptoQuant revealed that staked ETH has grown consistently over the past year, even as Ethereum’s price endured volatility.

This resilience could signal a longer-term bullish sentiment for the network, even if the ETH/BTC pair falters in the short term.

What’s next for Ethereum?

The broader market sentiment around Ethereum is mixed. While the growing total value staked paints a picture of investor confidence, the ETH/BTC pair’s inability to sustain key levels raises concerns.

ETH’s path forward depends heavily on its ability to regain strength against Bitcoin, particularly as Bitcoin’s dominance continues to rise.

For Ethereum to regain footing, a break above the 0.045 BTC resistance is essential. Meanwhile, the 0.033 BTC support remains critical to watch in the event of further declines.

Read Ethereum’s [ETH] Price Prediction 2024-25

Ethereum’s immediate outlook remains clouded by its struggles against Bitcoin, but its staking metrics and broader network fundamentals remain solid.

As the market eyes a potential reversal in the ETH/BTC pair, Ethereum’s strong staking participation and bullish USD performance could serve as lifelines, ensuring long-term viability even amid short-term volatility.

Credit: Source link