- Bitcoin’s next market peak could align with macro trends, institutional adoption, and ETF interest.

- Technical indicators suggest the Bitcoin market cycle top might occur in early 2025 or late 2026.

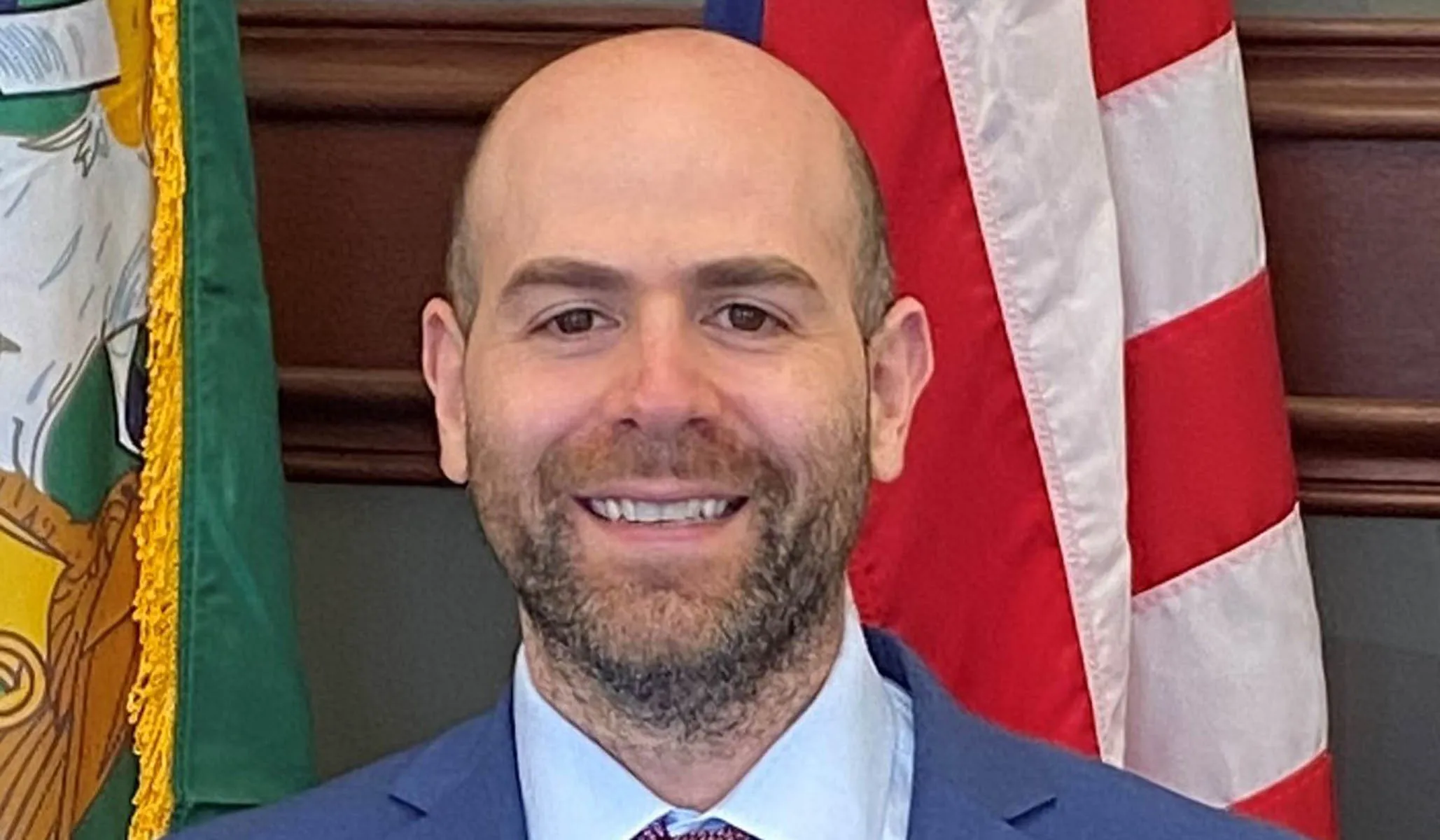

Lark Davis, a notable crypto analyst and content creator, recently gave his ideas on Bitcoin’s anticipated price swings in 2025 and beyond.

Davis investigated several scenarios and data points in a video titled “Price Prediction Scenarios For Bitcoin In 2025” on his YouTube channel that imply the crypto market might not be quite close to peaking.

Contrarian Perspectives on Bitcoin’s 2025 Growth Potential

Davis started by addressing doubters who say the market has already peaked, arguing that cryptocurrency may show amazing expansion in 2025. Among several factors he mentioned were macroeconomic changes, institutional and national acceptance, and Wall Street’s growing curiosity about Bitcoin ETFs.

These, he said, supply the next rally with a lot of gasoline. Further reinforcing the idea that more development is probably in Davis’s observation of on-chain and technical indicators of a market top not yet showing clear evidence.

Davis launched a survey on the social media platform X on which the crypto community expressed interesting opinions. While fewer people thought it may reach $250,000, most respondents projected a Bitcoin peak between $150,000 and $200,000.

Davis veered toward the contrarian perspective, implying that the larger range would be feasible given past patterns where the expectations of the majority usually fall short.

Bitcoin: Technical Patterns and Reliable Market Indicators

Examining technical indicators, Davis focused on the declining returns theory—that which holds fewer percentage increases in the next bull cycle. He noted that whereas the 2021 peak was somewhat modest, the 2017 market top showed a 230% rise from the prior high.

Based on this reasoning, Davis suggested in line with past trends a possible Bitcoin high between $150,000 and $180,000. He also spoke on the relevance of the Mayor Multiple and the 200-day Simple Moving Average (SMA), which point to a logical $170,000 price goal.

Davis also looked at the Pi Cycle Top indicator, a device traditionally accurate in spotting market cycle highs. Davis says this signal might flash a peak as early as March or April 2025. Although it is a lagging indicator, he underlined that for traders it usually offers a useful indication to consider profit-taking.

Selling based on this indicator let investors take advantage of large gains in past cycles, even if the market rallied somewhat later.

Strategic Insights for Bitcoin’s Future Growth

Davis also brought up other charts implying a possible breach above $200,000 and the golden ratio multiplier. Based on previous trends, he analyzed, the market might witness a surge to $250,000 or perhaps more by late 2025 or early 2026.

This situation fits more general macroeconomic patterns, including the predicted first quarter of 2026 high of the world M2 money supply.

When one considers past cycles, Davis underlined the need for timing and reasonable expectations. From the 2021 bull run, he related his personal experiences whereby many, including himself, expected a $100,000 Bitcoin but were later proved mistaken. This time he intends to approach the market from a more measured and fact-based standpoint.

Meanwhile, as of writing, BTC is trading at about $98,195.78, up 4.43% over the last 24 hours and pushing its market cap back above $1.9 trillion.

[mcrypto id=”19649″]

Recommended for you:

Credit: Source link