- MKR has surged by 11.52% over the past week

- Analyst predicted MKR might be set for a rally, in light of a key buy signal

Over the past week, the cryptocurrency market has seen significant recovery on the charts. Although Maker [MKR] has been lagging behind, its gains over the past few days have outweighed weekly losses. In fact, at the time of writing, MKR was trading at $1683. This marked a 11.52% hike over the past week.

Prior to this, Maker had been on a downward trajectory, declining by 6.68% on monthly charts.

Despite the recent upsurge, however, Maker’s prices remained significantly below its recent high of $3,125 recorded in July. Additionally, it’s still down by approximately 72.2% from its ATH of $6,391.

Therefore, recent market conditions have left analysts talking about the factors driving its latest surge. One such analyst is Ali Martinez, with the analyst claiming that MKR’s performance in the RWA sector is key to its surge. In doing so, he cited the TD sequential Indicator as a sign of further gains.

Maker’s performance in the RWA sector

According to Martinez, Maker is one of the leading players in the RWA sector. MakerDao has expanded its exposure to RWA since mid-2023. As of 2023, the total value of RWAs backed by DAI was over $2 billion. This highlighted the commitment to integrate these assets into DeFi. Additionally, in September 2024, MakerDao revealed plans to invest an additional $1 billion of its reserves in tokenized U.S Treasuries, thus further strengthening its involvement in the RWA space.

Also, MakerDao has aimed to introduce RWAs as collateral to enhance the stability of DAI. Such initiatives have seen DAI’s market value grow to $5.3 billion, with its daily trading volume hitting $86.8 million.

These developments in Maker’s ecosystem have left Martinez to predict an upcoming rally.

What does market sentiment say?

In his analysis, Martinez cited the TD Sequential indicator as a sign of a potential bull rally.

Source: X

According to the analyst, this indicator has flashed four buy signals on the 3-day chart, which suggests it’s the perfect time for accumulation. He added that this will push MKR to hit $1,850.

Based on this analogy, the downtrend may be coming to an end and a reversal might be imminent. The fact that the TD sequential has flashed four buy signals on the 3-day chart means strong potential for an upward movement. The 3-day chart is a long timeframe, and is more reliable than short-term signals.

Thus, multiple buy signals reinforce the likelihood of a bullish reversal.

On the metrics front…

On other fronts too, it would seem that MKR might be well-positioned for more gains on the price charts.

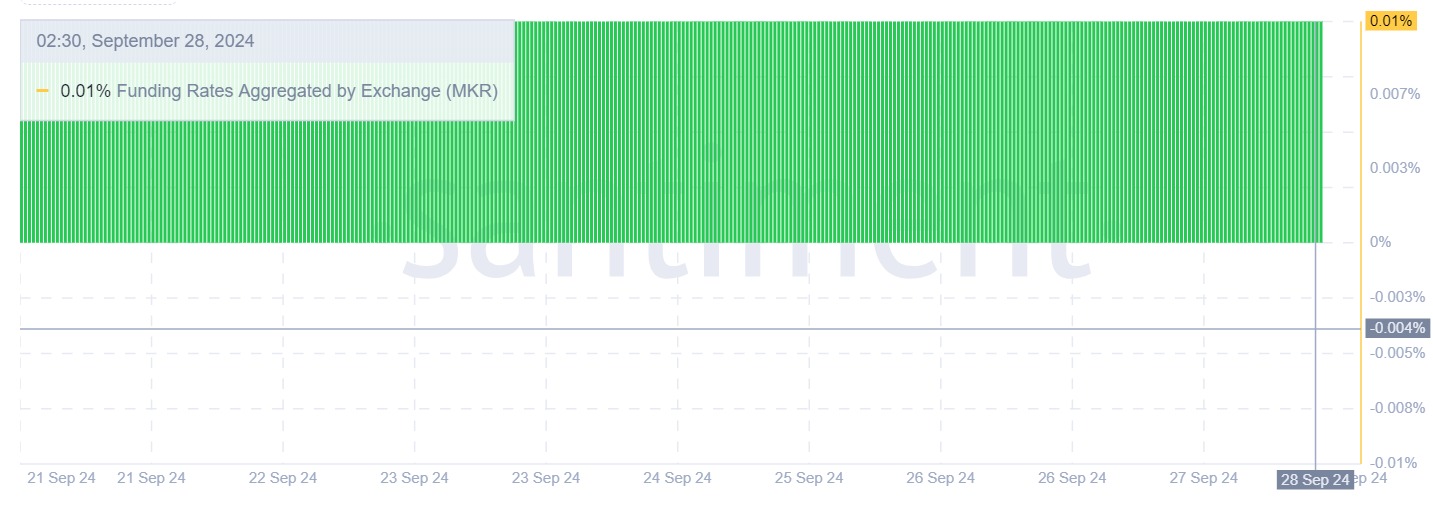

Source: Santiment

For example, Maker’s funding rate aggregated by exchange has remained positive over the past week. This means that long position holders are paying short holders – A sign of their confidence in the altcoin’s future prospects.

This is a bullish signal as longs are willing to pay a fee to hold their trade.

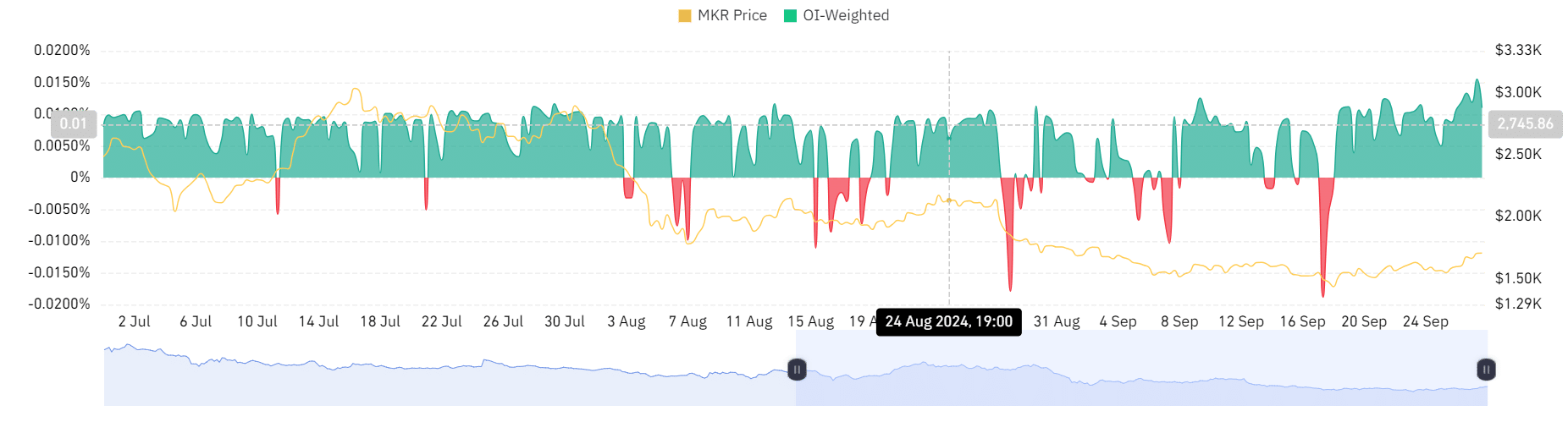

Source: Coinglass

This demand for long positions can be further supported by a positive OI-weighted funding rate. For the last 10 days, MKR has seen higher demand for long positions than shorts.

This means investors are anticipating the altcoin’s price will rise. This is another bullish signal.

Source: Santiment

Finally, open interest per exchange rose over the past week from $40 million to $52.55 million at press time. This translates to greater funds inflows, with traders opening new positions while the existing ones hold their positions.

Therefore, as observed by Martinez, the prevailing market sentiment could set MKR for further gains on the price charts. As such, if the prevailing market sentiment is maintained, MKR could hit $1,760 in the short term.

Credit: Source link