With a rising channel in the daily chart, the ONDO price trend maintains an overall bullish outlook for the sideline traders. However, as the ongoing negative cycle gains momentum with the increasing incoming supply, the altcoin may soon take a critical hit.

Nevertheless, the overnight recovery of 6% to avoid a dump to the dynamic 50D EMA reveals a potential comeback in the near future for Ondo. Will the overnight recovery lead to a trend reversal?

ONDO Price Performance

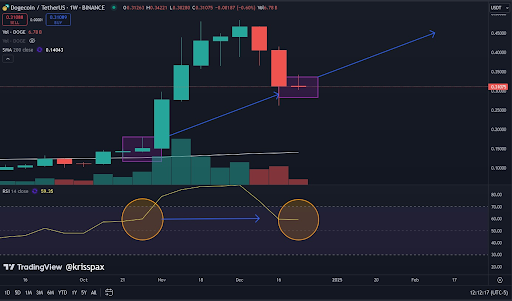

With the last bullish cycle starting from the $0.72 mark at the support trendline, the ONDO price surged 100% in 20 days. As the bull run peaked at $1.44, the price action revealed an overhead resistance trendline.

TradingView

Starting a bear cycle from the newly discovered trendline, the ONDO price dropped 18.51% within five days. As the supply subsided, the bullish comeback formed a 6% green candle after the 8% fall a day prior.

This recovery forms a Harami candle pattern in the daily chart and teases an early bull cycle if the buyers undermine the 8% candle today. For this, the closing price of the altcoin must surpass the opening price of the bearish candle at $1.30.

Currently, the ONDO price trades at $1.26 with a long tail formation and a 0.56% drop. Hence, the daily candle reveals demand at lower levels and a potential bullish comeback in the later half of the day.

Technical Indicators:

MACD: The bearish crossover in the MACD and signal lines are intact with the negative cycle.

Will Bulls Cross The $1.30 Threshold?

With a bullish comeback preparations, the ONDO price attracts the price action traders. As they await a bullish closing above $1.30, the overnight jump boosts the overall confidence.

However, the broader market sentiment remains volatile in the FOMC meeting backdrop. Hence, a news-based FUD sellout could undermine the buyers’ side.

As per the trend-based Fibonacci levels, the breakout rally could aim at the 2.618 level at $1.52.

Also Check Out : Crypto Markets Collapsing Hard: Here’s Why Traders are Turning Bearish on Bitcoin

Credit: Source link