Speech by Fabio Panetta, Member of the Executive Board of the ECB, at a panel on the future of crypto at the 22nd BIS Annual Conference, 23 June 2023

Basel, 23 June 2023

Introduction

Some 15 years ago, software developers using the pseudonym Satoshi Nakamoto created the source code of what they thought could be decentralised digital cash.[1] Since then, crypto has relied on constantly creating new narratives to attract new investors, revealing incompatible views of what crypto-assets are or ought to be.

The vision of digital cash – of a decentralised payment infrastructure based on cryptography – went awry when blockchain networks became congested in 2017, resulting in soaring transaction fees.[2]

Subsequently, the narrative of digital gold gained momentum, sparking a “crypto rush” that led to one in five adults in the United States and one in ten in Europe speculating on crypto, with a peak market capitalisation of €2.5 trillion.[3]

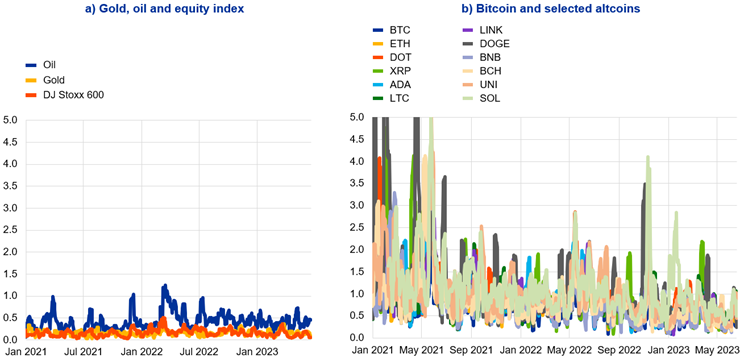

However, this illusion of crypto-assets serving as easy money and a robust store of value dissipated with the onset of the crypto winter in November 2021. The fall in the price of cryptos (Chart 1) led to a decrease of around €2 trillion worth of crypto assets within less than a year. This caught millions of investors unprepared.[4] An estimated three-quarters of bitcoin users suffered losses on their initial investments at this time.[5]

Chart 1

Prices of bitcoin and selected altcoins

(USD thousands)

Source: CryptoCompare. Notes: The data are for the period from 1 January 2015 to 15 June 2023 and are based on the price of crypto-assets as in the Crypto Coin Comparison Aggregated Index (CCCAGG) provided by CryptoCompare. The altcoins’ names are abbreviated as follows: Bitcoin (BTC), Ether (ETH), Polkadot (DOT), Ripple (XRP), Cardano (ADA), Litecoin (LTC), Chainlink (LINK), Dogecoin (DOGE), Binance Coin (BNB), Bitcoin Cash (BCH), Uniswap (UNI), Solana (SOL).

Understandably, many are now questioning the future of crypto-assets.

But the bursting of the bubble does not necessarily spell the end of crypto-assets.[6] People like to gamble and investing in crypto offers them a way to do so.[7]

Crypto valuations are highly volatile, reflecting the absence of any intrinsic value. This makes them particularly sensitive to changes in risk appetite and market narratives. The recent developments that have affected leading crypto-asset exchanges have highlighted the contradictions of a system which, though created to counteract the centralisation of the financial system, has become highly centralised itself.

Today I will contend that due to their limitations, cryptos have not developed into a form of finance that is innovative and robust, but have instead morphed into one that is deleterious. The crypto ecosystem is riddled with market failures and negative externalities, and it is bound to experience further market disruptions unless proper regulatory safeguards are put in place.

Policymakers should be wary of supporting an industry that has so far produced no societal benefits and is increasingly trying to integrate into the traditional financial system, both to acquire legitimacy as part of that system and to piggyback on it. Instead, regulators should subject cryptos to rigorous regulatory standards, address their social cost, and treat unsound crypto models for what they truly are: a form of gambling.

This may prompt the ecosystem to make more effort to provide genuine value in the field of digital finance.

Shifting narratives: from decentralised payments to centralised gambling

The core promise of cryptos is to replace trust with technology, contending that the concept “code is law” will allow a self-policing system to emerge, free of human judgement and error. This would in turn make it possible for money and finance to operate without trusted intermediaries.

However, this narrative often obfuscates reality. Unbacked cryptos have made no inroads into the conventional role of money. And they have progressively moved away from their original goal of decentralisation to increasingly rely on centralised solutions and market structures. They have become speculative assets[8], as well as a means of circumventing capital controls, sanctions or financial regulation.

Blockchain limitations

A key reason why cryptos have failed to make good on their claim to perform the role of money is technical. Indeed, the use of blockchain – particularly in the form of public, permissionless blockchain – for transacting crypto-assets has exhibited significant limitations.[9]

Transacting cryptos on blockchains can be inefficient, slow and expensive; they face the blockchain trilemma, whereby aiming for optimal levels of security, scalability and decentralisation at the same time is not achievable.[10]

Crypto-assets relying on a proof-of-work validation mechanism, which is especially relevant for bitcoin as the largest crypto-asset by market capitalisation[11], are ecologically detrimental. Public authorities will therefore need to evaluate whether the outsized carbon footprint of certain crypto-assets undermines their green transition commitments.[12] Moreover, proof-of-work validation mechanisms are inadequate for large-scale use.[13] Bitcoin, for example, can only accommodate up to seven transactions per second and fees can be exorbitant.

While alternative solutions to overcome the blockchain trilemma and proof-of-work consensus shortcomings have emerged for faster and more affordable transactions, including those outside the blockchain, they have drawbacks of their own. “Off-chain” transactions conducted via third-party platforms compromise the core principles of crypto-assets, including security, validity and immutability.[14] Another important aspect is the operational risk inherent in public blockchains due to the absence of an accountable central governance body that manages operations, incidents or code errors.[15]

Moreover, the handling of crypto-assets can be challenging. In a decentralised blockchain, users must protect their personal keys using self-custody wallets, which can discourage widespread adoption due to the tasks and risks involved, for example the theft or loss of a key. Given the immutability of blockchains, they do not permit transaction reversal.[16]

Instability

Another key limitation of unbacked cryptos is their instability.

Unbacked cryptos lack intrinsic value and have no backing reserves or price stabilisation mechanisms.[17] This makes them inherently highly volatile and unsuitable as a means of payment. Bitcoin, for instance, exhibits volatility levels up to four times higher than stocks, or gold (Chart 2).

Chart 2

Price volatility of cryptos compared with other assets

(annualised seven-day rolling standard deviation of daily percentage changes of prices)

Sources: CryptoCompare, Bloomberg, Refinitiv and ECB calculations. Notes: The data are for the period from 1 January 2015 to 15 June 2023. For visibility reasons, the maximum of the y-axis for Chart 2, panel b is set to 5. Nevertheless, on 30 and 31 January 2021 the price volatility of DOGE exceeded 28. Oil data refer to the European Brent Spot price. The altcoins’ names are abbreviated as follows: Bitcoin (BTC), Ether (ETH), Polkadot (DOT), Ripple (XRP), Cardano (ADA), Litecoin (LTC), Chainlink (LINK), Dogecoin (DOGE), Binance Coin (BNB), Bitcoin Cash (BCH), Uniswap (UNI), Solana (SOL).

Such high volatility also means that households cannot rely on crypto-assets as a store of value to smooth their consumption over time. Similarly, firms cannot rely on crypto-assets as a unit of account for the calculation of prices or for their balance sheet.

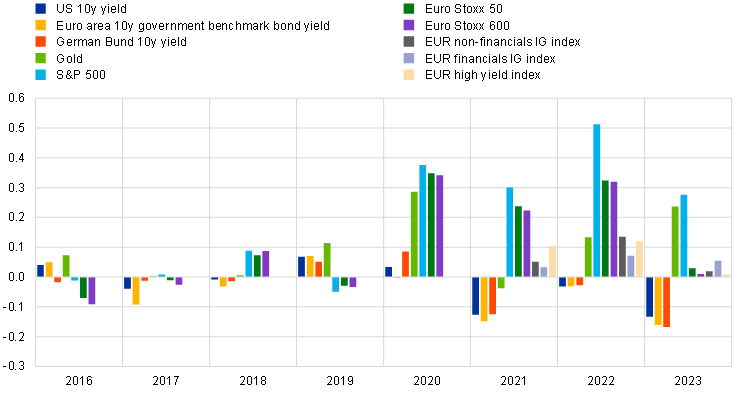

Moreover, unbacked cryptos do not improve our capacity to hedge against inflation. Indeed, their price developments exhibit an increasing correlation with stock markets (Chart 3). And empirical analysis finds that momentum in the crypto-asset market and global financial market volatility do have an impact on bitcoin trading against fiat currencies.[18]

Chart 3

Returns correlations of bitcoin vis-à-vis selected financial assets

(yearly rolling correlation)

Sources: Bloomberg, S&P Global iBoxx, CryptoCompare and ECB calculations. Notes: The data are for the period from 1 January 2016 to 16 June 2023.

Cryptos as a means of gambling and circumvention

But the very instability of unbacked cryptos does make them appealing as a means of gambling. And their use as such has been facilitated by the establishment of a centralised market structure that supports the broader use of crypto-assets.[19]

Crypto exchanges have become gateways into the crypto ecosystem, often providing user access to crypto markets in conjunction with other services like wallets, custody, staking[20] or lending. Off-chain grids or third-party platforms have offered users easy and cost-effective ways to engage in trading and speculation, while stablecoins are being used to bridge the gap between fiat and crypto by promising a stable value relative to fiat currency.[21]

Besides gambling, crypto assets are also being used for bypassing capital controls, sanctions and traditional financial regulation. A prime example is bitcoin, which is used to circumvent taxes and regulations, in particular to evade restrictions on international capital flows and foreign exchange transactions, including on remittances.[22] These practices may have destabilising macroeconomic implications in some jurisdictions, notably in developing and emerging markets.

Risks from the growing centralisation of the crypto ecosystem

The crypto ecosystem’s move away from its original goals towards more centralised forms of organisation, typically without regulatory oversight, is giving rise to substantial costs and an array of contradictions. There are two major facets to this phenomenon.

The re-emergence of classic financial sector shortcomings and vulnerabilities

First, dependence on third-party intermediaries, many of which are still unregulated, has resulted in market failures and negative externalities, which crypto was initially designed to sidestep.

The crypto ecosystem, for instance, has cultivated its own concentration risks, with stablecoins assuming a key role in trading and liquidity provision within decentralised finance markets.[23] The difficulties faced by prominent stablecoins in the past year likely contributed significantly to the noticeable downturn in these markets.[24]

Indeed, stablecoins often pose greater risks than initially thought. They introduce into the crypto space the kind of maturity mismatches commonly seen in money market mutual funds. As we have seen in the past year, redemption at par at all times is not guaranteed, risks of runs and contagion are omnipresent, and liquidation of reserve assets can lead to procyclical effects through collateral chains across the crypto ecosystem.

Another episode of instability driven by high concentration risk was the fall of the crypto exchange FTX. Initially the crisis seemed to primarily affect liquidity, but it quickly evolved into a solvency crisis. This situation arose due to FTX’s inadequate risk management, unclear business boundaries and mishandling of customer funds. The repercussions of this event rippled through the crypto ecosystem, causing cascading liquidations[25] that underscored the interconnectedness and opacity of crypto markets. Ultimately, it showcased how swiftly confidence in the industry could deteriorate.

Similarities to the FTX case can be seen in the recent civil charges brought by the US Securities and Exchange Commission against the biggest remaining crypto exchange: Binance. These civil charges allege that Binance’s CEO and Binance entities were involved in an extensive web of deception, conflicts of interest, lack of disclosure and calculated evasion of the law.[26] Should these allegations be proven, this would be yet another example of the fundamental shortcomings of the crypto ecosystem.

The recent crypto failures also show that risk, in itself, is technology-neutral. In financial services, it does not matter if a business ledger is kept on paper as it was for hundreds of years, in a centralised system as we have now or on a blockchain as in the crypto asset ecosystem. In the end, whether a firm remains in business or fails depends on how it manages credit risk, market risk, liquidity risk and leverage. Crypto enthusiasts would do well to remember that new technology does not make financial risk disappear. The financial risk either remains or transforms into a different type. It is like pressing a balloon on one side: it will change in shape until it pops on the other side. And if the balloon is full of hot air, it may rise for a while but will burst in the end.

Links with the traditional financial sector

The second contradiction arises from the crypto industry’s attempt to strengthen ties with actors in the financial system, including banks, big tech companies and the public sector.

Major payment networks[27] and intermediaries[28] have enhanced their support services for crypto-assets. Numerous prominent tech companies, including Meta (formerly Facebook) and Twitter, have explored ways to incorporate crypto into their platforms.[29] By leveraging their large customer base and offering a mix of payments and other financial services, tech firms, especially big techs, could solidify the ties between crypto-assets and the financial system.

The recent failures of Silvergate Bank and Signature Bank have highlighted the risks for banks associated with raising deposits from the crypto sector. The stability of these deposits is questionable given cryptos’ volatility. The discontinuation of the Silvergate Exchange Network and SigNet, which functioned as a quasi-payment system for the crypto investments of Silvergate Bank and Signature Bank clients, also shows how crypto-assets service providers depend on the traditional financial sector for settlement in fiat money.

The crypto industry not only seeks to strengthen its ties with the traditional financial industry. It also seeks to gain access to the public safety net that strongly regulated financial entities benefit from.[30] Indeed, Circle, the issuer of the USD Coin (USDC) tried to gain access to the Federal Reserve’s overnight reverse repurchasing facility in order to back its stablecoin.[31]

The crypto industry is seeking to grow by parasitising the financial system: it touts itself as an alternative to the financial sector, yet it seeks shelter within that very sector to address its inherent risks, all in the absence of adequate regulatory safeguards.

The public response: backing, regulating or innovating?

The public sector response can be encapsulated in three main suggestions.

Not giving in to the temptation to offer public backing to cryptos

First, the temptation to offer public backing to cryptos must be resisted.

The idea of permitting stablecoin issuers as non-bank financial institutions to hold their reserves at central banks might seem appealing, but could lead to serious adverse consequences.

By granting stablecoins access to the central bank’s balance sheet, we would effectively outsource the provision of central bank money. If the stablecoin issuer were able to invest its reserve assets[32] in the form of risk-free deposits at the central bank, this would eliminate the investment risks that ultimately fall on the shoulders of stablecoin holders. And the stablecoin issuer could offer the stablecoin holders a means of payment that would be a close substitute for central bank money.[33]

This would compromise monetary sovereignty, financial stability and the smooth operation of the payment system. For example, a stablecoin could displace sovereign money by using the large customer network of a big tech, with far-reaching implications.[34] Therefore, central banks should exercise prudence and retain control over their balance sheet and the money supply.

Regulating cryptos adequately and comprehensively

Second, regulators should refrain from implying that regulation can transform crypto-assets into safe assets. Efforts to legitimise unsound crypto models in a bid to attract crypto activities should be avoided.[35]

Moreover, the principle of “same activity, same risk, same regulation” should be endorsed. Cryptos cannot become as safe as other assets and investors should be aware of the risks. Anti-money laundering/countering the financing of terrorism rules should be enforced, and crypto activities of traditional firms should be carefully monitored.

While some jurisdictions attempt to apply existing regulatory frameworks to crypto-assets, the EU’s Markets in Crypto-Assets Regulation offers a customised regulatory structure that applies to all 27 EU Member States and draws on existing regulation where appropriate (e-money being one example). The EU has also updated existing regulation, for instance by extending the travel rule to crypto transactions.[36]

Despite the EU taking the lead in establishing a comprehensive framework regulating crypto activities, further steps are necessary. All activities related to the crypto industry should be regulated, including decentralised finance activities like crypto-asset lending or non-custodial wallet services[37]. Moreover, the regulatory framework for unbacked crypto-assets may be deemed lighter than for stablecoins as it relies mainly on disclosure requirements for issuing white papers[38], and on the supervision of the service providers which will offer them for trading. The risks posed by unbacked crypto-assets, which are largely used for speculative purposes, should be fully recognised. Enhancing transparency and awareness of the risks associated with crypto-assets and their social cost are critical aspects of this approach. Public authorities will also need to address those social costs: for instance, cryptos’ ecological footprint cannot be ignored in view of environmental challenges.

Additionally, the experience of FTX, which expanded massively with little oversight, underscores the importance of global crypto regulation and regulatory cooperation. The Financial Stability Board’s recommendations[39] for the regulation and oversight of crypto-asset activities and markets need to be finalised and implemented urgently, also in non-FSB jurisdictions. The Basel Committee on Banking Supervision’s standard on the prudential treatment of banks’ crypto-asset exposures is a positive step in this direction. It stipulates conservative capital requirements for unbacked crypto-assets with a risk weight of 1,250%, as well as an exposure limit constraining the total amount of unbacked crypto a bank can hold to generally below 1% of Tier 1 capital. It will be key for the European Union and other Basel jurisdictions to transpose the Basel standard into their legislation by the 1 January 2025 deadline[40].

However, regulation alone will not be sufficient.

Innovating: digital settlement assets and central bank digital currencies

Third, the public sector needs to contribute to the development of reliable digital settlement assets.

Central banks are innovating to provide a stability anchor that maintains trust in all forms of money in the digital age. Central bank money for retail use is currently only available in physical form – cash. But the digitisation of payments is diminishing the role of cash and its capacity to provide an effective monetary anchor. A central bank digital currency would offer a digital, risk-free standard and facilitate convertibility among different forms of private digital money. It would uphold the singleness of money and protect monetary sovereignty. We are advancing with our digital euro project and aim to complete our investigation phase later this year.

Furthermore, the tokenisation of digital finance may require central banks to modify their technological infrastructure supporting the issuance of central bank money for wholesale transactions. This could involve establishing a bridge between market distributed ledger technology (DLT) platforms and central bank infrastructures, or a new DLT-based wholesale settlement service with DLT-based central bank money.[41] We will involve the market in the exploratory work that we have recently announced.[42]

Conclusion

To conclude, crypto-assets have been promoted as decentralised alternatives promising more resilient financial services. However, the reality does not live up to that promise. The blockchain technology underpinning crypto-assets can be extremely slow, energy-intensive and insufficiently scalable. The practicality of crypto-assets for everyday transactions is low due to their complex handling and significant price volatility.

To address these drawbacks, the crypto ecosystem has changed its narrative, favouring more centralised forms of organisation that emphasise crypto speculation and quick profit. But recent events have exposed the fragility of the crypto ecosystem, demonstrating how quickly confidence in crypto-assets can evaporate. In many respects, this ecosystem has recreated the very shortcomings and vulnerabilities that blockchain technology initially intended to address.

Further complicating matters, the crypto market seeks integration into the financial sector for increased relevance and public sector support. This would not provide the basis of a sustainable future for crypto. If anything, it would only heighten contradictions and vulnerabilities, resulting in greater instability and centralisation.

The public sector should adopt a determined position by establishing a comprehensive regulatory framework that addresses the social and environmental risks associated with crypto, including the use of unbacked crypto-assets for speculative purposes. It should also resist calls to provide state backing for cryptos, which would essentially socialise crypto risks. The public sector should instead focus its efforts on contributing to the development of reliable digital settlement assets, including through their work on central bank digital currencies.

Decisive action of this kind should motivate the crypto ecosystem, including its foundational technology, the blockchain, to realign its objectives towards delivering real economic value within the digital finance landscape.

Credit: Source link