- PNUT’s breakout from a symmetrical triangle and strong MACD and RSI signals suggest a bullish setup.

- Balanced liquidation data and whale accumulation support the case for a sustained rally.

Peanut the Squirrel [PNUT] has recently broken out of a symmetrical triangle pattern on the 1-hour chart, a move that often indicates bullish continuation. PNUT was in a crucial retesting phase around $2.1389 at press time.

If this retest successfully holds, it could confirm the breakout and pave the way for a renewed upward push. This retest level is vital. Therefore, any successful hold here would likely attract more buyers, amplifying bullish sentiment.

Looking at the MACD, a positive signal emerges as the MACD line has moved above the signal line, confirming growing bullish momentum.

Additionally, the RSI hovers around 56.89, suggesting PNUT is still within a comfortable range and not yet overbought. These technical indicators support the possibility of further gains, especially if buyers respond positively to the breakout retest.

Source: TradingView

Whale activity: Big players backing PNUT

On-chain data reveals significant whale interest in PNUT, with its largest holder controlling approximately 27 million tokens valued at over $51 million, as per Lookonchain analytics.

This major trader has actively engaged in 39 token trades, with PNUT standing out as a particularly successful investment.

The large stake held by this whale reflects confidence in PNUT’s potential, as substantial holdings by high-profile investors often add stability to a token.

Consequently, continued whale involvement could lend more strength to PNUT’s upward movement, creating a favorable environment for further gains.

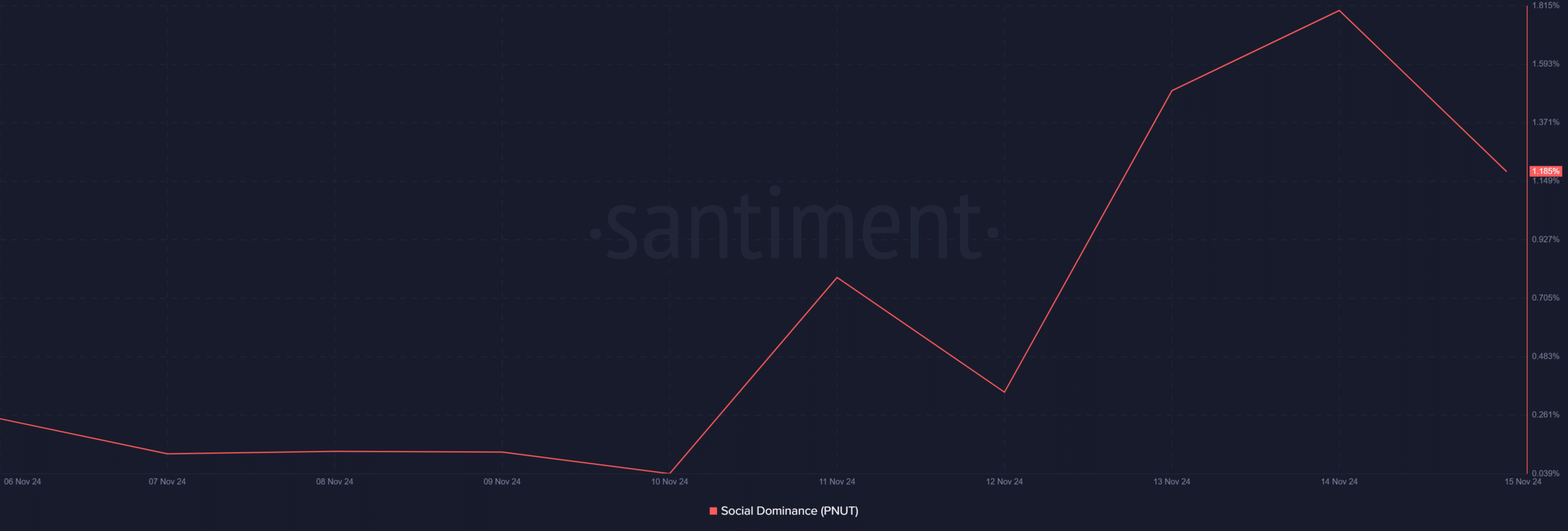

Social dominance: Slight dip or shift in focus?

The social dominance has decreased from 1.8% to 1.19%, indicating a potential dip in retail attention.

However, this decline may be temporary, as a confirmed breakout could quickly reignite social interest. Lower social dominance could mean traders are watching the retest closely before fully committing.

Therefore, a strong rally after the retest could draw back attention and drive up social metrics, further boosting momentum.

Source: Santiment

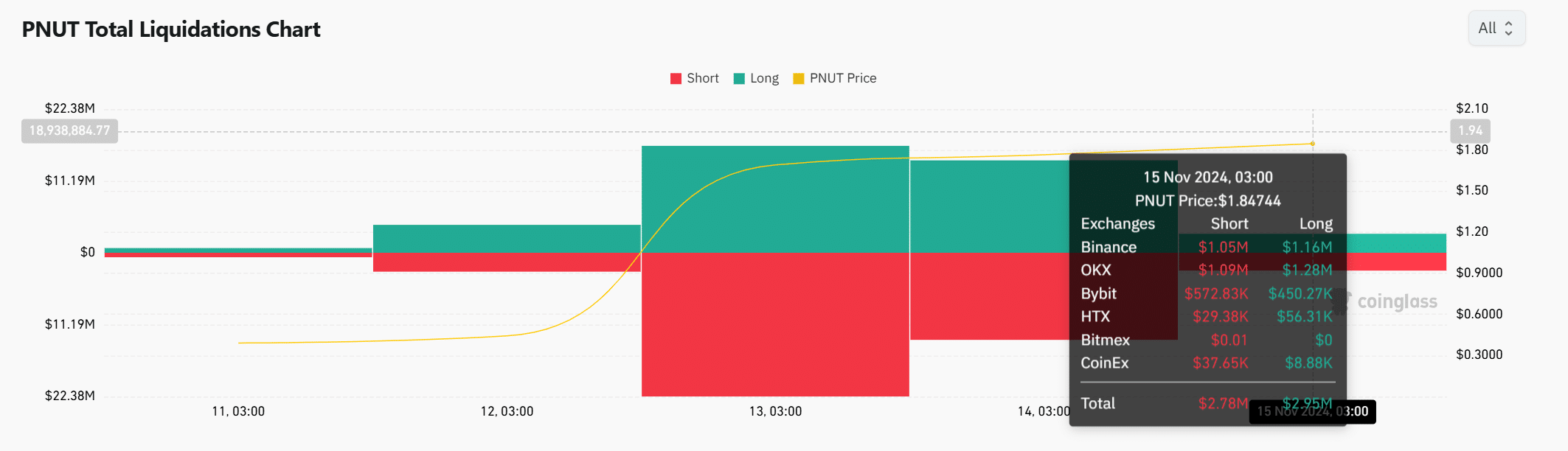

Liquidations: Longs and shorts near balance

Recent liquidation data shows a close balance between long and short positions, with $2.95 million in longs and $2.78 million in shorts. This balanced liquidation environment suggests that while optimism surrounds PNUT’s price, caution persists.

If the breakout retest holds, increasing long liquidations could add fuel to a potential rally, intensifying the upward drive.

Source: Coinglass

PNUT poised for further gains

PNUT’s breakout from the triangle pattern, supported by bullish technical indicators and strong whale activity, establishes a promising bullish outlook.

While social dominance has seen a minor dip, the technical strength and balanced liquidation ratio indicate that PNUT is primed for further gains. If the retest holds, PNUT appears well-positioned for a sustained rally in the near term.

Credit: Source link