Quick Take

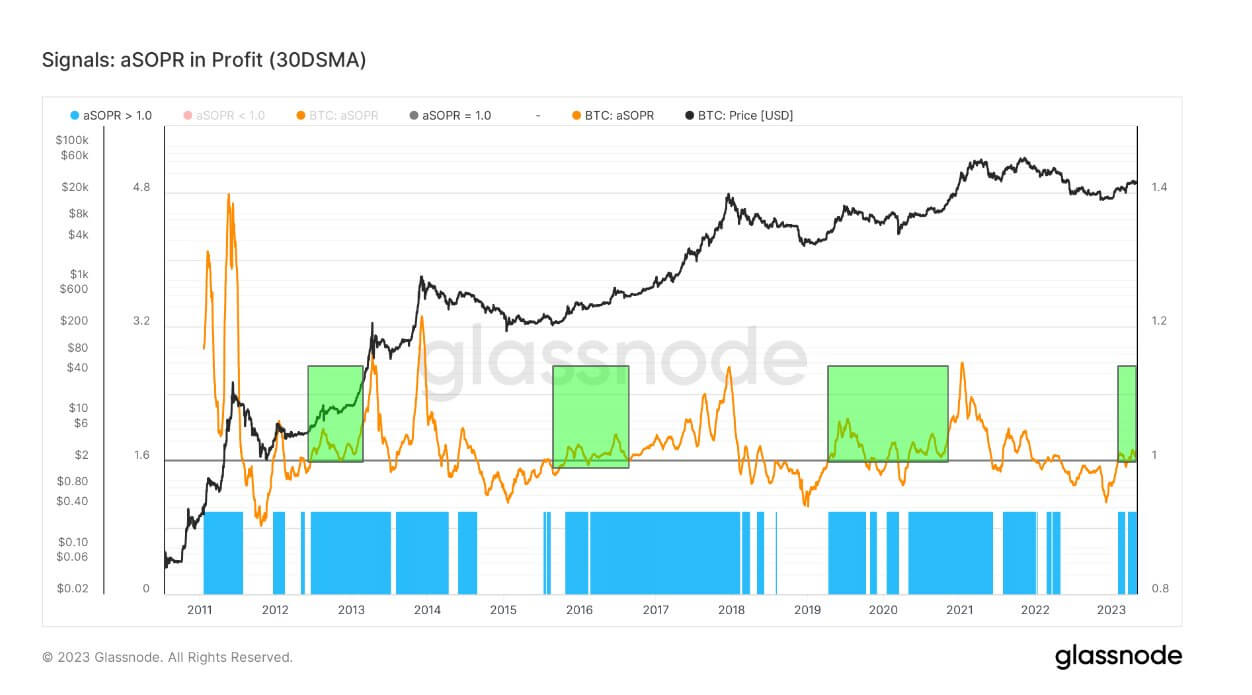

- The Spent Output Profit Ratio (SOPR) is computed by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output — or simply: price sold / price paid.

- Adjusted SOPR is SOPR ignoring all outputs with a lifespan of less than 1 hour.

- aSOPR has been holding above 1.0 since the SVB collapse back in March. This signifies that the market is now, on average, realizing profits in on-chain spending.

- This generally aligns with a healthier inflow of demand (to absorb profit-taking) and a more constructive opinion of the asset.

- We tested 1.0 at the end of March, and I expect to test it a few more times — similar to previous bear markets. We can undershot 1.0 to flush out leverage, similar to 2019.

- While both long and short-term holders realized profits for the first time since May 2022, this was in a downtrend in price. So we are in a similar period to early 2020 regarding price ascending.

The post Profit realization on the rise: aSOPR holds steady above 1.0 since March’s SVB collapse appeared first on CryptoSlate.

Credit: Source link

![Fantom [FTM] crypto price prediction: Why $1.6 is near](https://ambcrypto.com/wp-content/uploads/2024/12/Fantompriceprediction-1000x600.jpg)