In a new development, on-chain data from DeFiLlama shows that Pump.fun, a launchpad on Solana allowing users to create and deploy tokens, mainly meme coins, generates more fees than some of the top protocols in Solana and Ethereum.

Pump.fun Generates More Fees Than Ethereum

DeFiLlama data shows that the launchpad generated $5.3 million in fees in the past day alone. At this pace, it is nearly double the $2.3 million by Lido, a top liquidity staking platform on Ethereum.

Interestingly, Pump.fun generates more fees than Ethereum, a network known for charging relatively higher gas fees than all other blockchains. Over the last day, Ethereum generated $1.67 million in fees.

Meanwhile, Solana transfers and on-chain smart contracts deployment saw the platform distribute $1.32 million in fees to validators. The interest in Pump.fun has also seen the network outpace Tron, which dominates USDT transfer. Over the last day, Tron generated $1.15 million in fees.

The surging interest in Pump.fun, explaining the spike in on-chain gas fees, could be due to its value proposition. Through this launchpad, users cannot only create but also instantly trade tokens for under $2 in “just a single click,” per their description on X. It is the ease of use and the spike in meme coin popularity on Solana that has catapulted Pump.fun to the forefront in crypto.

Plans To Make Token Minting Successful

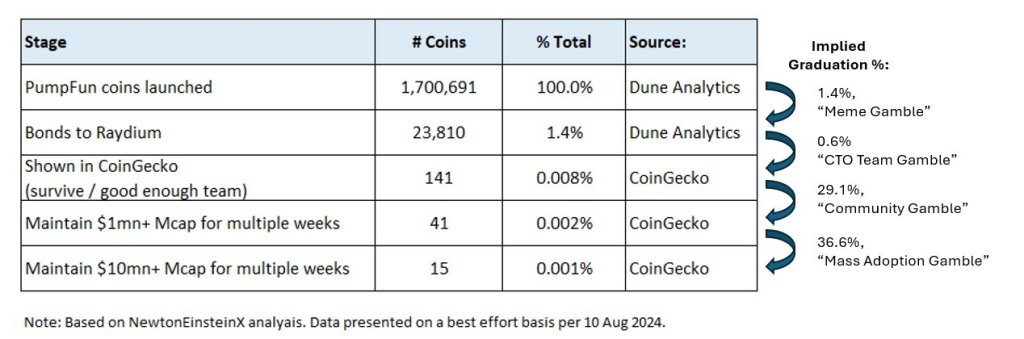

Even as Pump.fun soars, generating millions in fees, research findings point to other troubles. It is emerging that less than 0.002% of all tokens deploying from the launchpad ever reach a market cap of $1 million.

Of the millions of meme coins launching, only 41 maintained a market cap of $1 million for over a few weeks. The dismal performance could be because most meme coins launching do not offer any value and are simply for entertainment.

In a new update on August 9, Pump.fun said it plans to make changes and incentivize the creation of more successful tokens. The launchpad will, therefore, not charge users any fee when they deploy a new token.

In the earlier arrangement, users had to pay roughly $2 in SOL to create tokens. This fee is now transferred to the first buyer of the token.

Overall, the goal is to encourage developers to at least push their tokens through the critical “bonding curve” stage, driving their market cap at least above $70,000. If the token passes through this phase, it will automatically be listed on Raydium while the issuer is paid 0.5 SOL.

Feature image from Canva, chart from TradingView

Credit: Source link

![Mapping Fantom’s [FTM] short-term target of $1.47 and beyond](https://ambcrypto.com/wp-content/uploads/2025/01/FTM-1000x600.webp)