- Render has surged by 14.08% over the past week.

- Amidst a strong positive market sentiment, short sellers lack conviction in a potential downside.

Since crypto markets recovered following Fed rate cuts, AI-themed coins have made significant gains on price charts. With optimism and increased adoption, AI- coins are leading the market surge. Amidst this growth, Render [RENDER] is at the center of it all.

In fact, as of this writing, Render was trading at $6.47. This marked a 24.87% increase on monthly charts with an extension to the bullish trend by a 14.08% increase over the past week.

Since hitting a monthly low of $4.45, the altcoin has maintained an upward momentum. Therefore, these market conditions strengthened Render to absorb liquidation pressure according to ChainStatsPro analysis.

What market sentiment indicates

In their analysis, ChainStatsPro posited that Render is experiencing a healthy and strong market as the altcoin is absorbing liquidation while spot CVDs remain flat.

Source: ChainStatsPro

What this simply means is that there’s no excessive buying or selling pressure which signals market indecision.

Further, the analyst pointed out that short sellers are uncertain implying they lack strong conviction in their positions. Therefore, short sellers are unsure about the potential downside and thus are not betting on prices to decline further.

Based on this analogy, the market is strong enough to absorb liquidations without experiencing extreme volatility and short sellers are not certain of any further downside.

What Render charts suggest

While the metrics highlighted by ChainStatsPro offer a positive market outlook, it’s essential to determine what other fundamentals indicate.

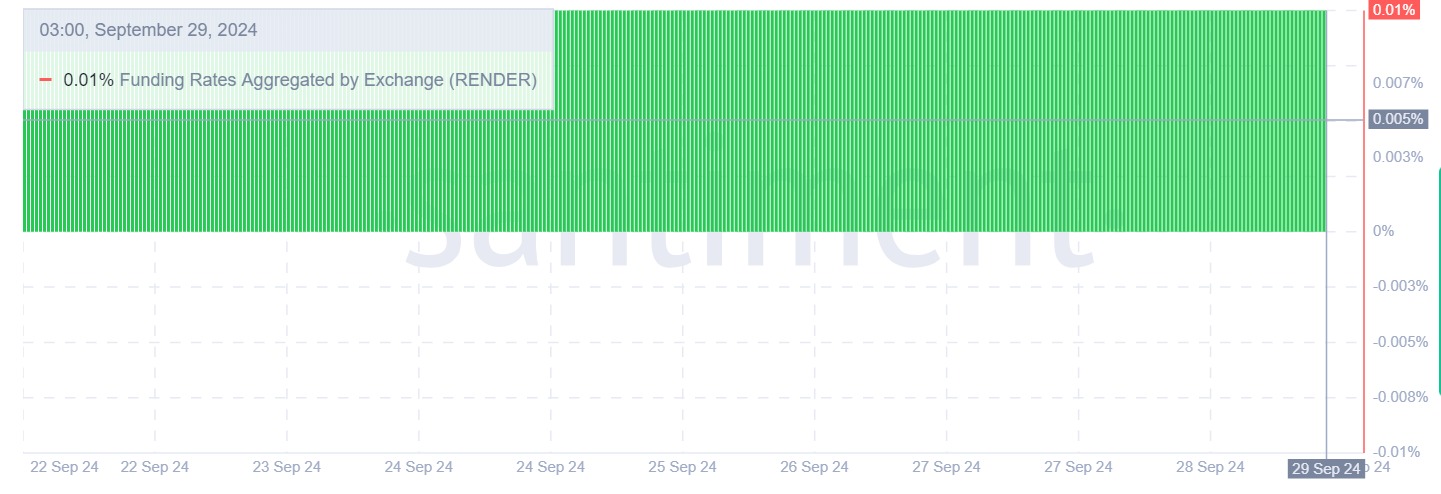

Source: Santiment

For starters, Render’s funding rate aggregated by exchange has remained positive over the past week. A positive funding rate indicates that long position holders are paying short sellers to hold their trades.

This shows strong conviction among investors of future price increases.

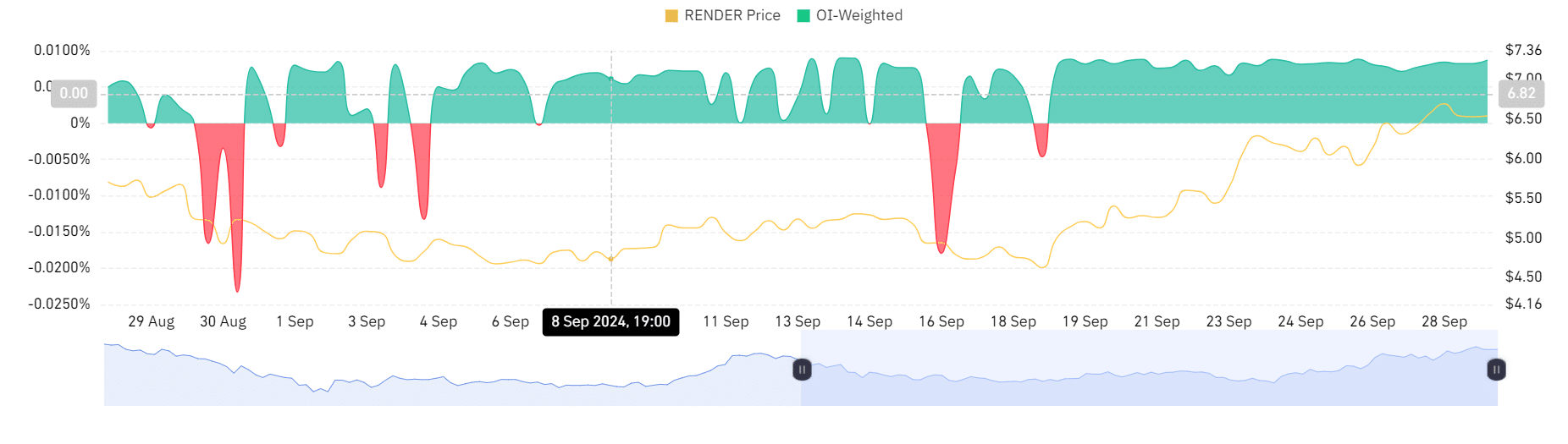

Source: Coinglass

Additionally, this demand for a long position is further supported by a positive OI-weighted funding rate. This has been positive for the last two weeks suggesting that, even during downturns, investors are willing to pay a fee to short sellers to hold their positions.

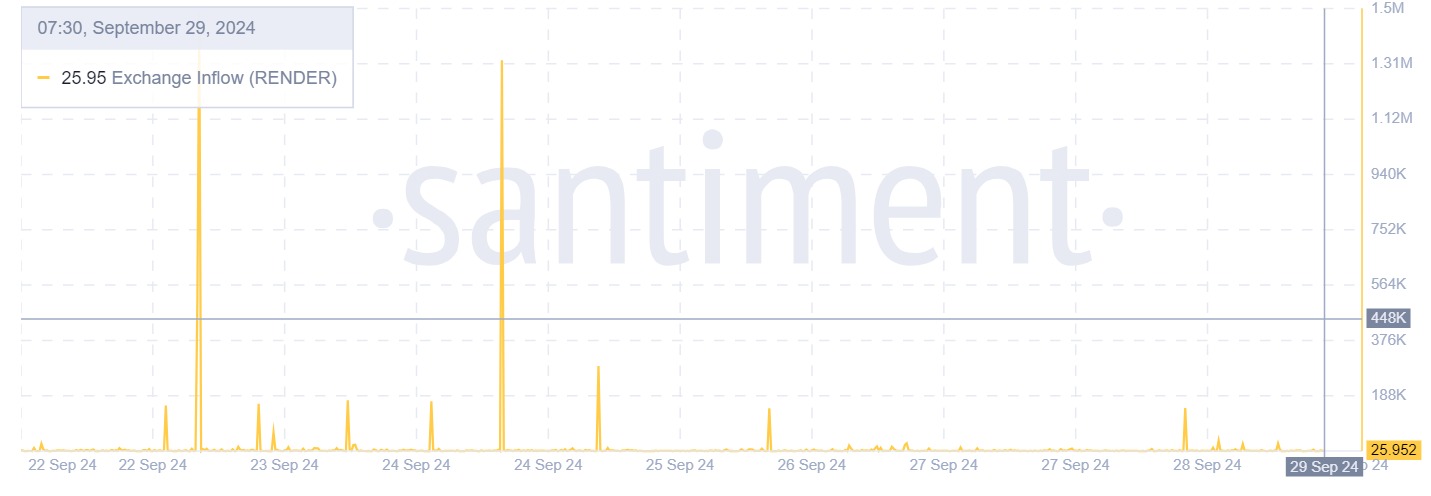

Source: Santiment

Finally, Render’s exchange inflow has declined over the past week from a high of 1.48 million RNDR tokens to 25.952 at press time. This shows holding behavior with investors storing their assets in cold wallets.

Such behavior implies that investors are not willing to sell as they anticipate more gains.

Is your portfolio green? Check the Render Profit Calculator

Therefore, based on these market conditions, AMBCrypto’s analysis show Render is experiencing positive market sentiment and investor favorability. Such market sentiment could set the altcoin for further gains on price charts.

If the prevailing market conditions are maintained, Render will break out from the $7.0 resistance level. A breakout from this level will strengthen the altcoin to challenge June highs of $10.5.

Credit: Source link