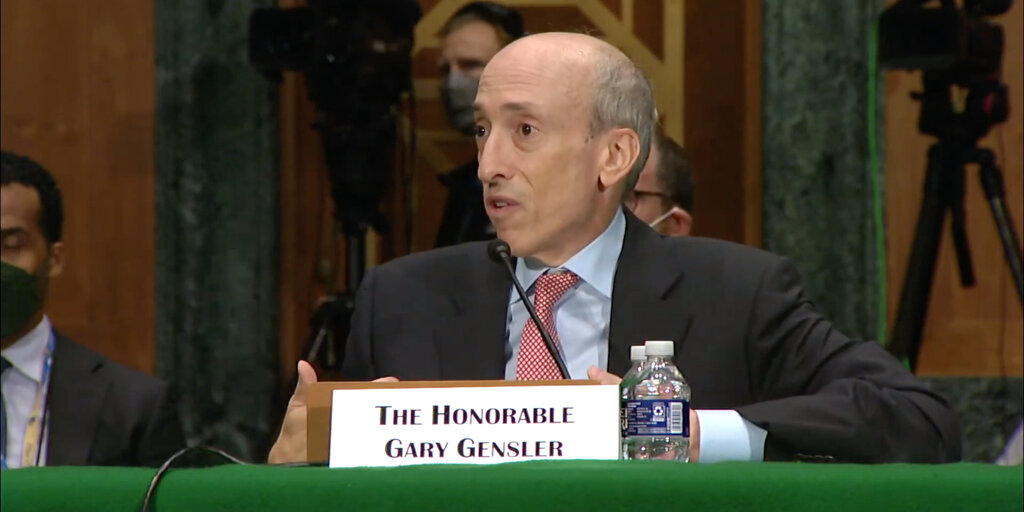

SEC Chair Gary Gensler isn’t mincing words.

Ahead of Piper Sandler’s Global Exchange & Fintech Conference this week, he again slammed the crypto industry for its “many problems,” urging for further investor protections.

“With wide-ranging noncompliance, frankly, it’s not surprising that we’ve seen many problems in these markets.” Gensler said, “We’ve seen this story before. It’s reminiscent of what we had in the 1920s before the federal securities laws were put in place. Hucksters. Fraudsters. Scam artists. Ponzi schemes. The public left in line at the bankruptcy court.”

This comes amid the SEC’s legal battles against Binance, Coinbase, and other crypto entities as part of an aggressive industry-wide crypto crackdown.

Gensler highlighted key cases where exchanges have unlawfully offered securities without registering them with the SEC, explaining why this should be a concern for investors.

“These alleged failures deprive investors of critical protections, including rulebooks that prevent fraud and manipulation, proper disclosures, segregation of customer assets, safeguards against conflicts of interest, oversight by a self-regulatory organization, and routine inspection by the SEC,” The SEC chair said.

He pointed to the case against Binance claiming that Sigma Chain—a Binance affiliate controlled by the Binance founder Changpeng Zhao—”engaged in manipulative trading and conducted wash trading” to fraudulently inflate trading volumes.

The Chair of the SEC continued to spotlight key areas where he sees wrongdoings in the industry but stops himself in the interest of time.

“I could go on, but in a market rife with fraud, abuse, and noncompliance, there are too many to list.” He continued, “We’ve also seen numerous companies—before and after FTX—blow themselves up, hurting countless investors in their wake. As a result of the bankruptcies of BlockFi, Celsius, FTX, Genesis, and other crypto firms, investors often are left lining up in court.”

Frustrations with the SEC

At the same event, the CEO of Galaxy Digital, Mike Novogratz, claimed that his company is planning to accelerate its plans to move off-shore due to a “legislative stalemate” in the U.S.

“Companies like ours are looking at how fast we can move people offshore,” he said. “The regulatory environment has made institutional crypto a difficult, difficult place to be.”

Galaxy Digital is not the only crypto company frustrated with the confusing regulatory environment either.

Late last month, Coinbase accused the SEC of deliberately ignoring its “petition for rulemaking,” which aimed to provide “clarity and certainty regarding the regulatory treatment of digital asset securities.”

Still, Coinbase plans to remain stoic in the face of the SEC lawsuit as it aims to carry on with “business as usual.”

Ripple took also aim at the SEC, claiming that “confusing” regulations in the U.S. will push crypto companies to leave.

“Frankly, it’s why you’re seeing entrepreneurship and investment flowing into other jurisdictions—and certainly Europe has been a significant beneficiary of the confusion that has existed in the U.S.,” the Ripple CEO said in May.

The SEC’s crypto crackdown has seen unrest across the industry resulting in companies considering options beyond America’s borders.

Credit: Source link