The digital gold rush is on, and this time, Wall Street’s titans are leading the charge. A recent surge in holdings by Spot Bitcoin Exchange-Traded Funds (ETFs) indicates a rising tide of institutional investment in the leading cryptocurrency. This influx of big money could propel Bitcoin prices to new heights, but not without a few wrinkles.

BlackRock, Grayscale Lead The Institutional Charge

The rise of Spot Bitcoin ETFs wouldn’t be possible without the heavyweights of the financial world throwing their weight behind it. Asset management giants like BlackRock, Grayscale, and Fidelity Investments have been instrumental in driving this trend.

According to Arkham Investments, a blockchain data analysis firm, Grayscale and BlackRock are the undisputed frontrunners in the global Spot Bitcoin ETF arena. Grayscale Bitcoin Trust (GBTC) boasts the largest war chest, holding roughly 288,000 BTC, while BlackRock’s iShares Bitcoin Trust (IBIT) isn’t far behind with holdings exceeding 284,000 BTC.

Source: Dune Analytics

Other notable players include Fidelity with their Wise Origin Bitcoin BTC (FBTC) and established names like Bitwise and Active Managers adding to the ETF ecosystem.

Institutions Dive Into The Bitcoin Pool

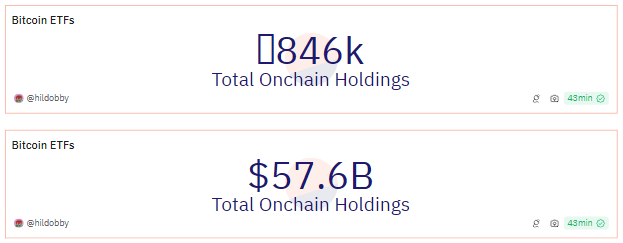

Data from blockchain analytics firm Dune paints a clear picture: Spot Bitcoin ETFs in the United States alone are stockpiling a substantial amount of Bitcoin, currently sitting on a collective treasure trove of around 846,000 coins. This translates to nearly $58 billion under management by these ETF issuers, showcasing a clear institutional appetite for Bitcoin.

Source: Dune Analytics

Zooming out to the global landscape, the story gets even more captivating. Industry estimates suggest that global Spot Bitcoin ETF holdings have eclipsed the 1 million BTC mark, signifying a significant milestone.

32 #Bitcoin Spot ETFs now hold ~1 Nakamoto of $BTC pic.twitter.com/OpHridlymc

— Michael Saylor⚡️ (@saylor) May 27, 2024

Bullish Signs For Bitcoin’s Future

The surge in institutional demand for Bitcoin through Spot ETFs echoes the positive sentiment witnessed earlier this year. Following the long-awaited approval of Spot Bitcoin ETFs in January, Bitcoin’s price skyrocketed to a record-breaking high above $73,000 in March. This growth coincided with a surge in mainstream adoption, partly fueled by the ease of access provided by Spot ETFs.

The growing participation of institutional investors is an indication that the bitcoin industry is developing. This pattern and encouraging technical indications imply that Bitcoin may have promising future months. But a word of caution is in order.

BTC market cap currently at $1.3 trillion. Chart: TradingView.com

The entry of institutional heavyweights like BlackRock and Fidelity, wielding billions of dollars through Spot ETFs, is a significant development for Bitcoin. It legitimizes the cryptocurrency in the eyes of mainstream investors and injects fresh capital into the market.

Related Reading: Argentina’s Bitcoin Adoption Is Exaggerated, El Salvador Official Says

This unprecedented level of institutional involvement could very well trigger another price surge for Bitcoin, replicating the one witnessed earlier this year and impacting the overall trajectory of the cryptocurrency market.

Featured image from Beamstart, chart from TradingView

Credit: Source link