- Sui broke past the $1.05 level to flip its market structure bullishly.

- The swift gains were supported by a volume increase and made a move toward $1.77 more likely.

Sui [SUI] was on a good bullish run over the past week. Measured from Monday’s low to Sunday’s high, the token gained 51.35% and saw a pullback over the past 24 hours from the $1.5769 local high.

Its outlook was strongly bullish across the higher timeframes, although a short-term dip appeared likely. Here’s how swing traders can navigate the price trends over the next two weeks.

Is SUI overextended?

Source: SUI/USDT on TradingView

On Sunday, the 15th of September, Sui closed a daily trading session above the $1.05 mark. This level had been the previous local high, which forced a price rejection in August that saw Sui drop to the $0.79 support level.

Once this $1.05 level was breached, the daily market structure flipped bullishly. The buyers wasted no time making an impact in the market. Within the next week, they drove prices higher and posted a 51.33% move within three days from Tuesday to Friday.

The OBV surged past a local resistance level and the daily RSI reached 78, which was overbought territory. The speed of the gains meant a retracement was possible in the near-term.

The next few weeks would likely be bullish for SUI, as the 100% extension level at $1.77 is the next target. The $1.44-$1.52 resistance has been tested and could push the bulls back temporarily.

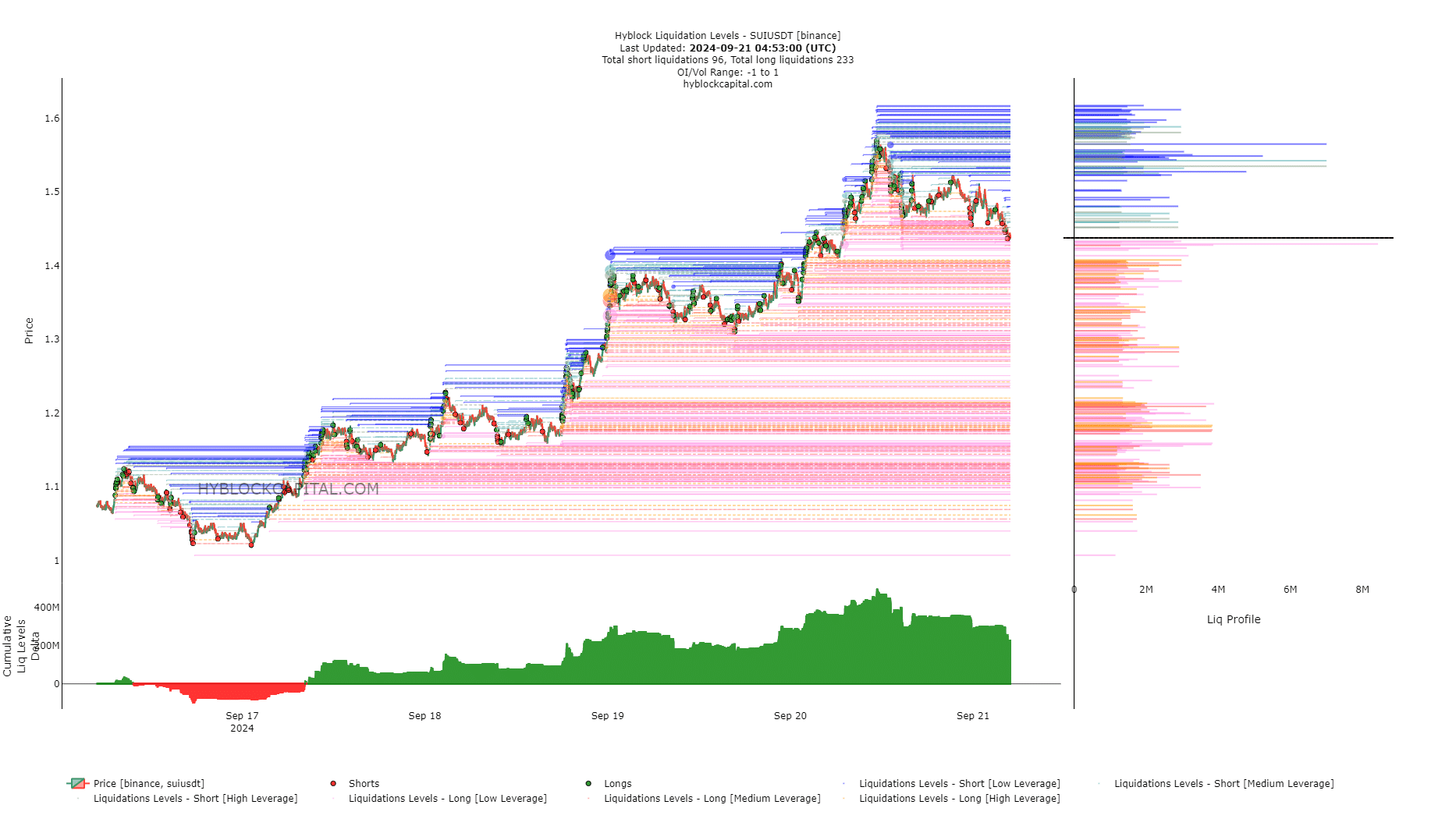

Liquidation levels show how low a dip could go

Source: Hyblock

AMBCrypto found that the cumulative liq levels delta was largely in favor of the bulls. This has slightly reduced in the past 24 hours as the token pulled back from $1.57 to $1.44, but there could be a deeper dip.

Read Sui’s [SUI] Price Prediction 2024-25

The cluster of liquidation levels at $1.42, $1.37, and $1.3 were the next short-term targets. A price bounce from these levels is anticipated for the next week, provided Bitcoin can stay above the $60k support.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Credit: Source link