- Uniswap saw a FOMO that ushered in price correction.

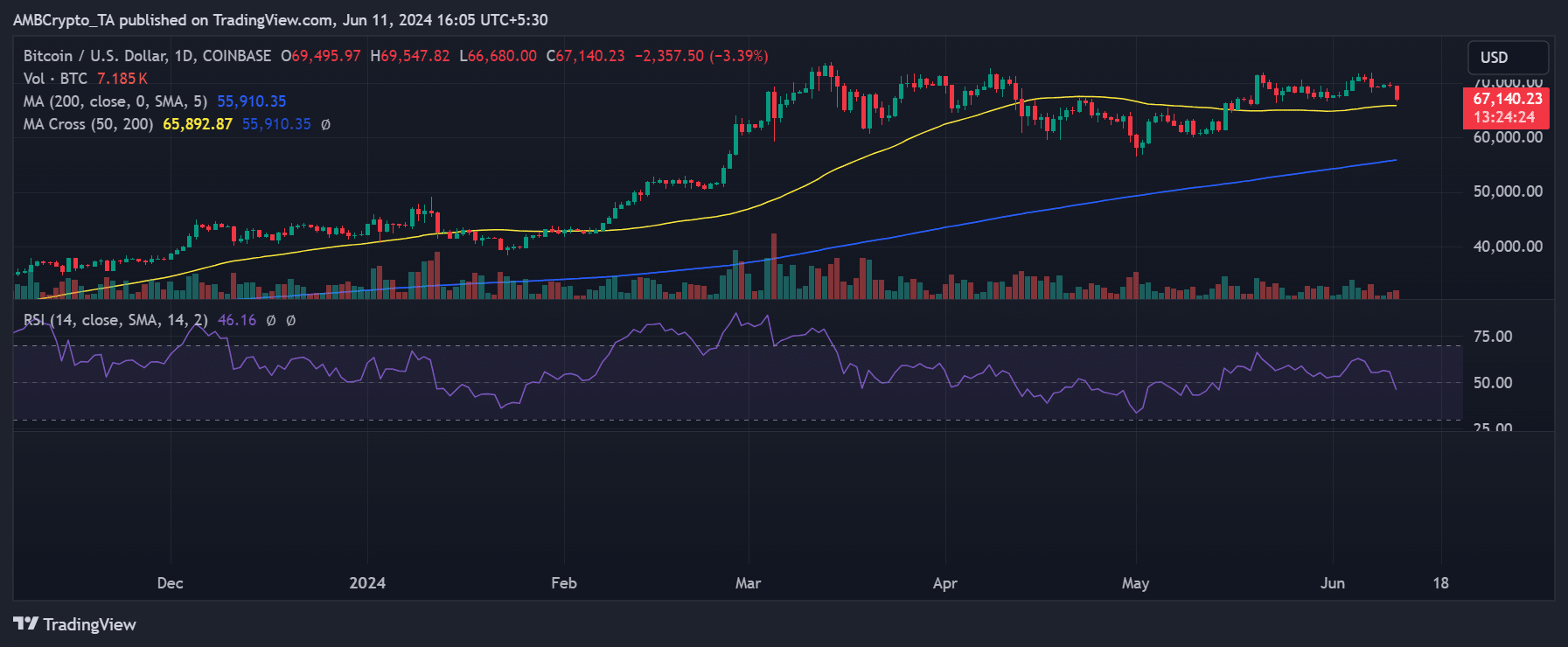

- BTC has fallen off the $69,000 price range.

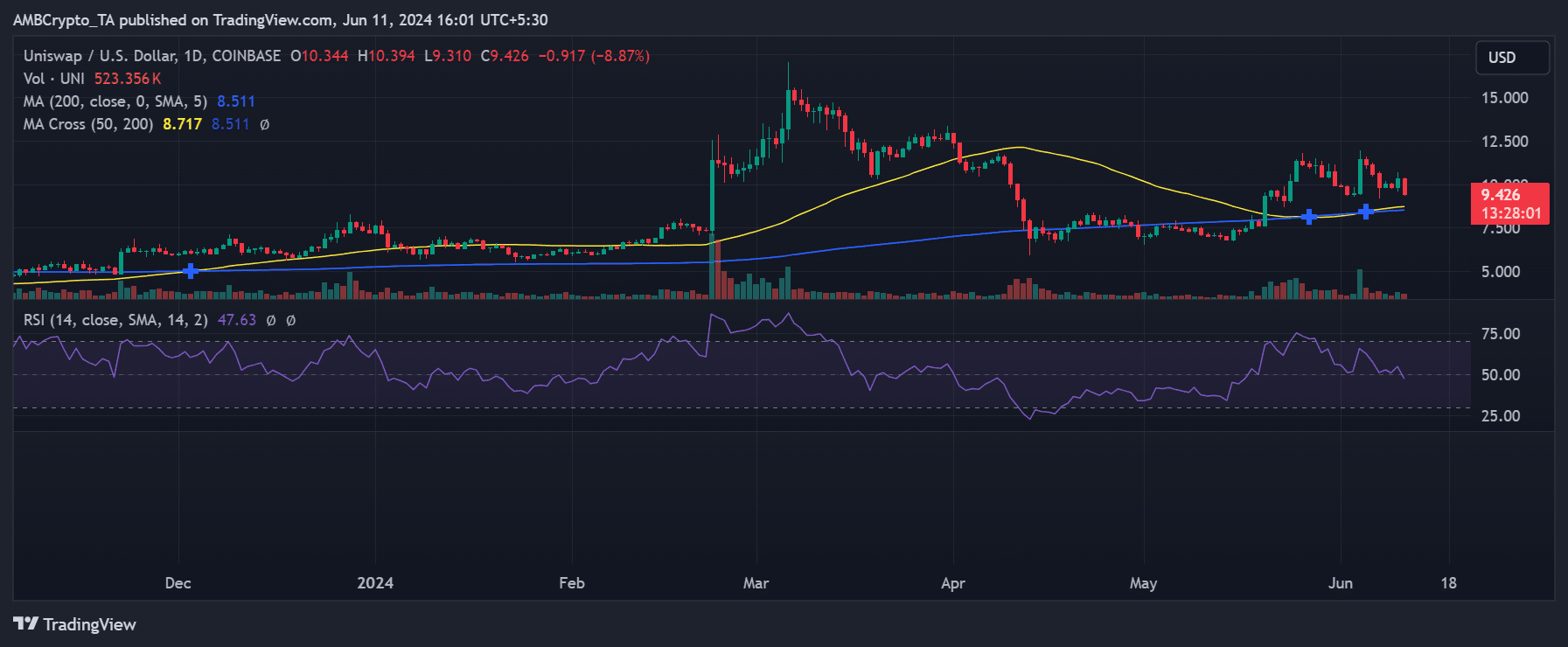

The price trend of Uniswap [UNI] stirred up Fear of Missing Out (FOMO) on the 10th of June, suggesting a potential correction. This correction has already begun, but might not be solely due to FOMO.

Bitcoin [BTC] also experienced a notable decline, and its trend typically impacts the broader market.

Uniswap and Bitcoin: Comparing social metrics

According to recent data from Santiment, Uniswap saw a spike in its social dominance on the 10th of June. The data indicated that UNI was the most notable among assets experiencing an increase on that day.

The price surge brought significant attention to UNI, creating FOMO.

However, the rise in price and social dominance was more of a bearish signal than a bullish one, especially considering the concurrent decline in Bitcoin, which typically influences the broader market sentiment.

Source: Santiment

AMBCrypto’s analysis of the Bitcoin social dominance trend showed that it did not witness any notable movement during the same time frame.

Although Bitcoin maintained a higher social dominance than UNI, its trend appeared relatively normal. As of this writing, BTC’s social dominance is around 23%, while UNI’s is around 0.5%.

How UNI trended

A look at Uniswap’s daily price showed an increase of 5% on the 10th of June, from around $9.80 to $10.30. However, this gain and more have since been wiped out.

As of this writing, Uniswap was trading at around $9.40, with a decline of over 8%.

Source: TradingView

The decline has pushed Uniswap into a bear trend. Its Relative Strength Index (RSI) showed that it is currently below the neutral line.

This decline is attributed to the rise in FOMO and the recent decline in Bitcoin.

How has Bitcoin fared?

AMBCrypto’s analysis of Bitcoin showed that it has declined by 0.2% in the last 24 hours, despite the absence of FOMO, unlike UNI. At press time, the king coin was trading at around $69,497.

Source: TradingView

Is your portfolio green? Check out the UNI Profit Calculator

As of this writing, this downward trend has continued, trading with an over 3% decline at around $67,400.

An analysis of its Relative Strength Index (RSI) showed it is now below the neutral line, indicating a bear trend.

Credit: Source link