- Whale bought 437K UNI, fueling price recovery.

- Uniswap targets $12 as buyers defended key $8.4 support levels.

Uniswap [UNI] was riding the bull run as whales actively accumulated the token behind the scenes. Can this help UNI outperform other tokens in the coming weeks?

Whale’s bold play on Uniswap

A recent post on X (formerly Twitter) by blockchain tracker Spot On Chain highlighted the activity of a DeFi whale who spent $4 million USDC to purchase 437,000 UNI tokens.

This whale, an early holder of UNI, has accumulated 2.248 million UNI tokens worth $20.8 million, with unrealized profits of $5 million (+31.5%), acquired at an average price of $7.06.

Following this massive purchase, Uniswap’s price has recovered from earlier losses, showing a 0.08% gain to trade at $9.17, at press time.

Additionally, trading volume has surged by 38.85% over the past 24 hours. This signaled increased interest and participation from traders and investors, likely fueled by this whale’s activity.

A drop in Uniswap addresses hints at…

Uniswap’s Daily Active Addresses(DAA) fluctuated between 6,000 and 10,000 from March to November.

A sharp spike on the 5th of November saw active addresses exceed 11,000, reflecting heightened user engagement during that period.

Source: DefiLlama

However, following this peak, the number of active addresses has gradually reduced, stabilizing between 8,000 and 9,000.

This decline indicated a potential cooling of speculative activity or reduced short-term trading interest.

Despite the reduction, the consistent activity levels suggested that core users and long-term participants continue to support the platform. This aligns with increased whale accumulation and steady trading volumes.

The decline also hints at a potential consolidation phase, where reduced participation could set the stage for renewed growth or significant market moves.

UNI targets $12 as buyers defend THIS support level

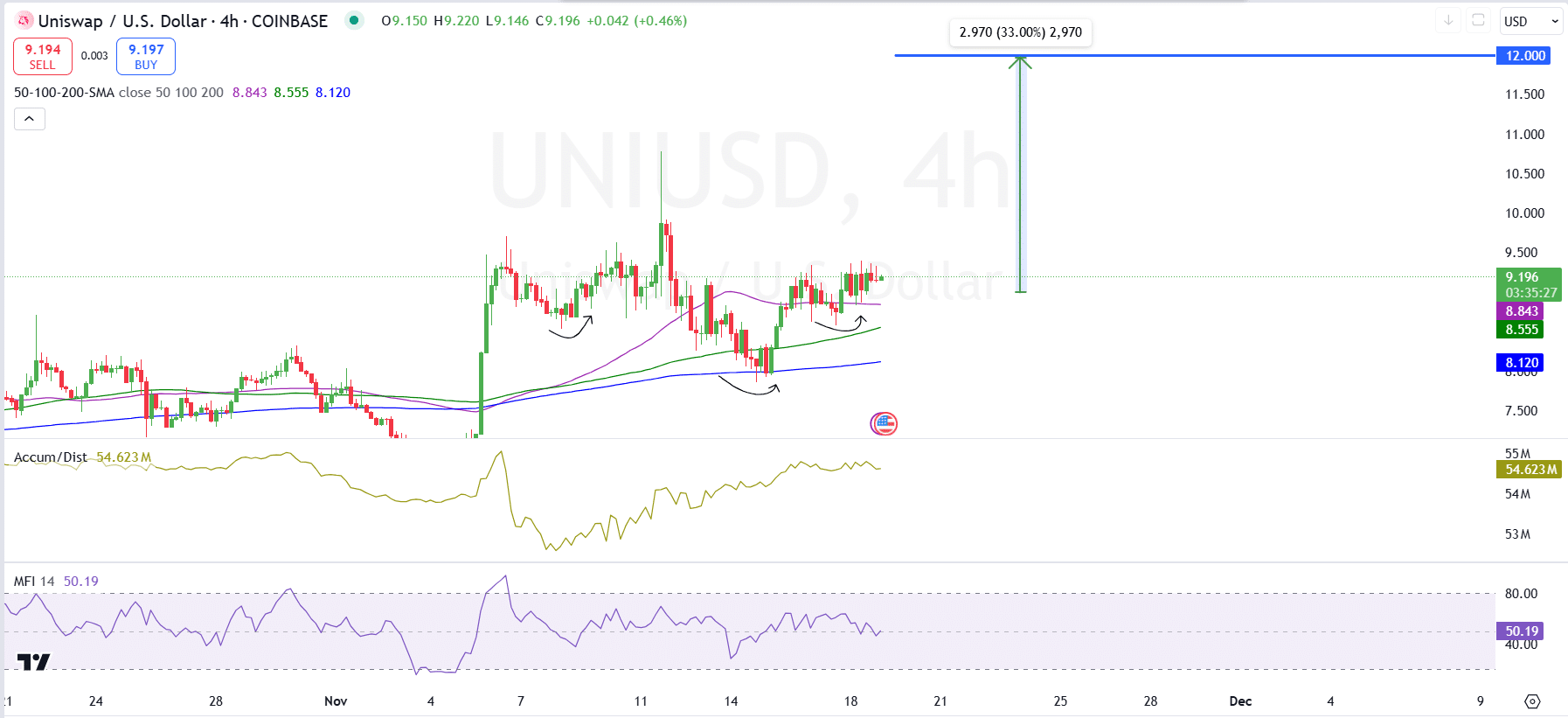

The four-hour chart for UNI highlightsed a bullish structure forming around key support levels.

Uniswap’s price treaded slightly above the 50 EMA of $8.84, the 100 EMA at $8.55, and the 200 EMA at $8.12, which all acted as strong support zones.

This positioning indicated that buyers are actively defending these levels, keeping the uptrend intact.

Source: Tradingview

The Accumulation/Distribution Line sat at 54.623M, reflecting steady accumulation as traders increase their positions in anticipation of higher prices.

Meanwhile, the Money Flow Index(MFI) is neutral at 50.19, suggesting that buying and selling pressure are balanced, with room for further upside momentum.

A breakout to the projected target of $12.00 represents a 33% increase from current levels.

Realistic or not, here’s UNI’s market cap in BTC’s terms

If the price maintains support above the 50 EMA and breaks past the $10 resistance, the bullish momentum could propel Uniswap toward this target.

However, a breakdown below $8.12 could invalidate the bullish setup and prompt further downside.

Credit: Source link