On the 22nd May, the United States House of Representatives passed a bill titled, ‘Financial Innovation and Technology for the 21st Century Act,’ that establishes a regulatory framework for cryptocurrencies and delineates responsibilities between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The CFTC would have the authority to regulate a digital asset as a commodity if the blockchain, or digital ledger, on which it runs is functional and decentralised, while the SEC would regulate a digital asset as a security if its associated blockchain is functional but not decentralised.

The bill amends both the Securities Exchange Act of 1934 and the Commodity Exchange Act of 1936 to divide responsibilities between the SEC, which regulates the securities market and the CFTC, which regulates derivatives like futures and options, on the basis of the nature of the blockchain. The bill classifies a blockchain as decentralised if “no person has unilateral authority to control the blockchain or its usage, and no issuer or affiliated person has control of 20% or more of the digital asset or the voting power of the digital asset.” The bill also excludes cryptocurrencies from the definition of “investment contracts” in the Securities Act of 1933.

Cryptocurrency developers are also subject to new disclosure rules, including information relating to the digital asset project’s operation, ownership, and structure. Crypto exchanges, brokers, and dealers will be required to provide appropriate disclosures to customers, segregate customer funds from their own and reduce conflicts of interest through registration, disclosure, and operational requirements.

Why It Matters

The core issue here is regulatory oversight. According to an explainer from Coindesk, US law defines ‘securities’, i.e financial instruments like stocks and bonds, as ‘investment contracts’, meaning that a person who invests money in a security “is led to expect profits solely from the efforts of the promoter or a third party.” If cryptocurrencies are considered to be securities, they would be subject to the SEC’s stringent compliance regime. The SEC has argued that the cryptocurrencies should be considered as securities, while the CFTC insists on classifying them as commodities as interchangeable, i.e, a bitcoin is interchangeable with another bitcoin.

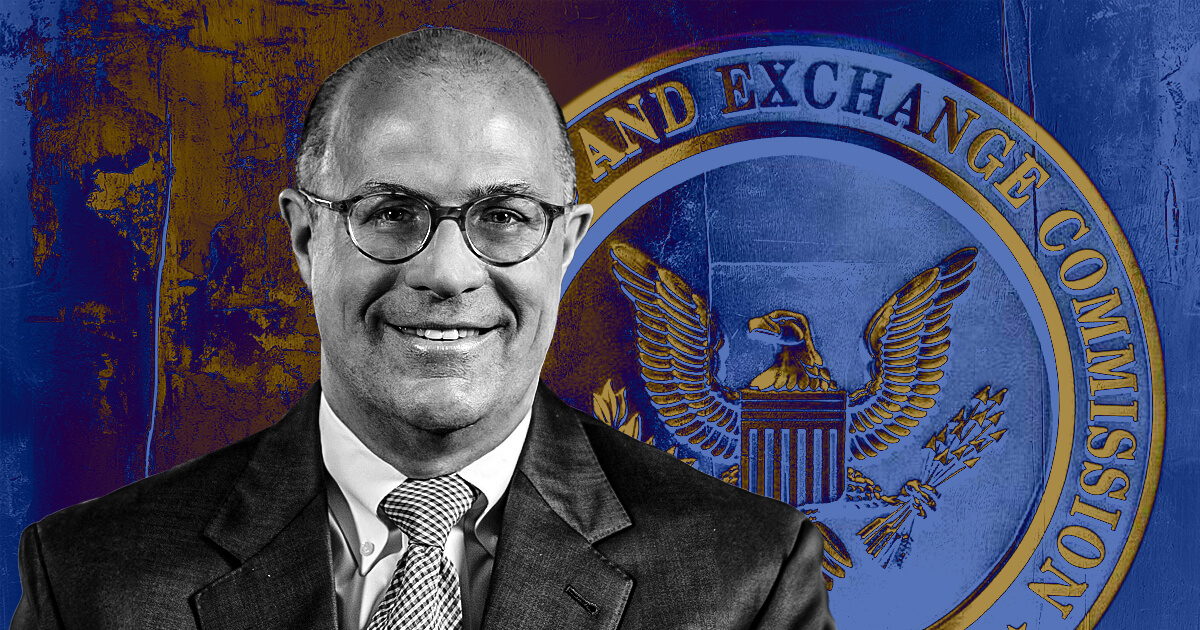

The bill was criticised by many people, including the SEC Chair Gary Gensler who argued that the bill “would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk.” In a public statement, he made the following points:

- By excluding investment contracts that are recorded on a blockchain from the statutory definition of securities, investors would no longer be protected by federal securities laws.

- The bill allows crypto issuers to self-certify whether their blockchains are decentralised or not and provides the SEC with 60 days to contest their claims. However, Gensler argued that this is insufficient time to adequately contest most of the claims. “Given limits on staff resources, and no new resources provided by the bill, it is implausible that the SEC could review and challenge more than a fraction of those assets,” he said.

- The bill determines whether securities laws should apply to a cryptocurrency or not on the basis of the nature of the blockchain, abandoning the Supreme Court’s long standing ‘Howey Test’. “But it’s the economic realities that should determine whether an asset is subject to the federal securities laws, not the type of recordkeeping ledger,” according to Gensler.

- The bill waters down regulations for the crypto currencies that do fall under the SEC’s remit.

- The legislation Excludes crypto trading platforms from the SEC’s jurisdiction and thus also excludes investors on crypto asset trading platforms from protections that other investors get.

- The bill creates a broad exclusion for organisations that fall under the category called “Decentralized Finance.”

- The bill may functionally eliminate existing exemptions by creating a new exempt offering framework.

- He states, “The self-certification process contemplated by the bill risks investor protection not just in the crypto space; it could undermine the broader $100 trillion capital markets by providing a path for those trying to escape robust disclosures, prohibitions preventing the loss and theft of customer funds, enforcement by the SEC, and private rights of action for investors in the federal courts. It could encourage non-compliant entities to try to choose what regulatory regimes they wish to be subjected to – not based on economic realities, but potentially based on a label.”

Gensler concludes, “The crypto industry’s record of failures, frauds, and bankruptcies is not because we don’t have rules or because the rules are unclear. It’s because many players in the crypto industry don’t play by the rules. We should make the policy choice to protect the investing public over facilitating business models of noncompliant firms.”

The passing of the bill comes in the backdrop of Congress’s rejection of SEC’s Staff Accounting Bulletin-121 (SAB-121), which views the staff with regards to the obligations a company had to safeguard crypto-assets of users. On 8th May, the House passed H. J. RES. 109, which overturned the bulletin and stated that “such rule shall have no force or effect.”

The White House criticised the resolution, arguing that it could “inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability.” Furthermore, President Biden threatened to veto the resolution if it was presented to him.

Biden also criticised the recently passed bill, stating “H.R. 4763 in its current form lacks sufficient protections for consumers and investors who engage in certain digital asset transactions.” However, he expressed a willingness to work with Congress on developing legislation for digital assets.

Also Read:

STAY ON TOP OF TECH NEWS: Our daily newsletter with the top story of the day from MediaNama, delivered to your inbox before 9 AM. Click here to sign up today!

Credit: Source link