- XRP’s price action was slightly bullish at press time

- Lack of demand meant the altcoin’s path north could be slow

The U.S. Securities and Exchange Commission filed its latest appeal on Thursday. The appeal seeks to reverse parts of the ruling made in favor of Ripple and XRP in July 2023. This, although the SEC now does not contest the decision that the sale of XRP through exchanges to retail investors was not sale of securities.

The impact of this appeal on the price has been negligible. For the most part, XRP has traded between the $0.52 and $0.62 levels since July. This trend has not changed and at press time, the token was still within a consolidation phase.

Positive reaction could encourage XRP buyers

Source: XRP/USDT on TradingView

XRP’s market structure was technically bullish, but the smaller range between $0.52-$0.62 meant this fact was not very significant. The defense of the $0.52 level in October could have been the trigger swing traders were looking for to go long.

The buy volume has been weak in October, even though XRP is up by 8% from its lows. The OBV showcased this observation and clung to a support level from August. The CMF indicated strong selling pressure in the past twenty periods since its calculation takes into account the sharp rejection from the $0.665 level.

The daily RAI was just below neutral 50. Taken together, swing traders can opt to go long based on the price action, but strong demand seened absent. There is a good chance other large-cap altcoins will outperform XRP in the coming days or weeks.

Derivatives data did not support the bullish case

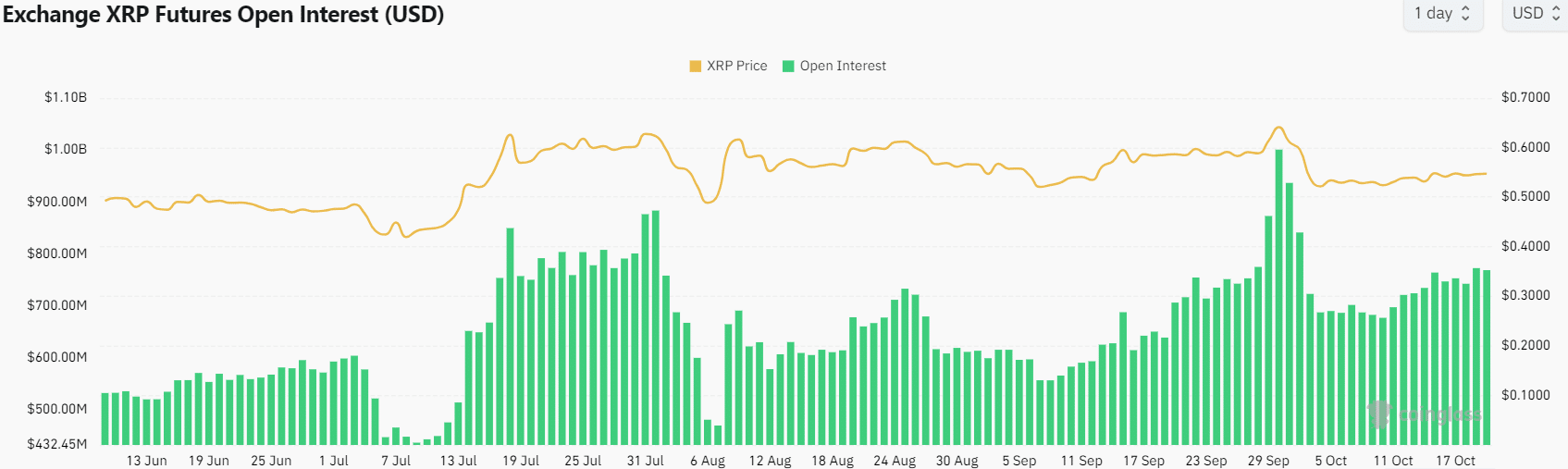

Source: Coinglass

The Open Interest had a reading of $772 million, a level it has remained at for a majority of the time since July. A price move beyond $0.62 would draw more speculators like it did in late September.

Source: Coinglass

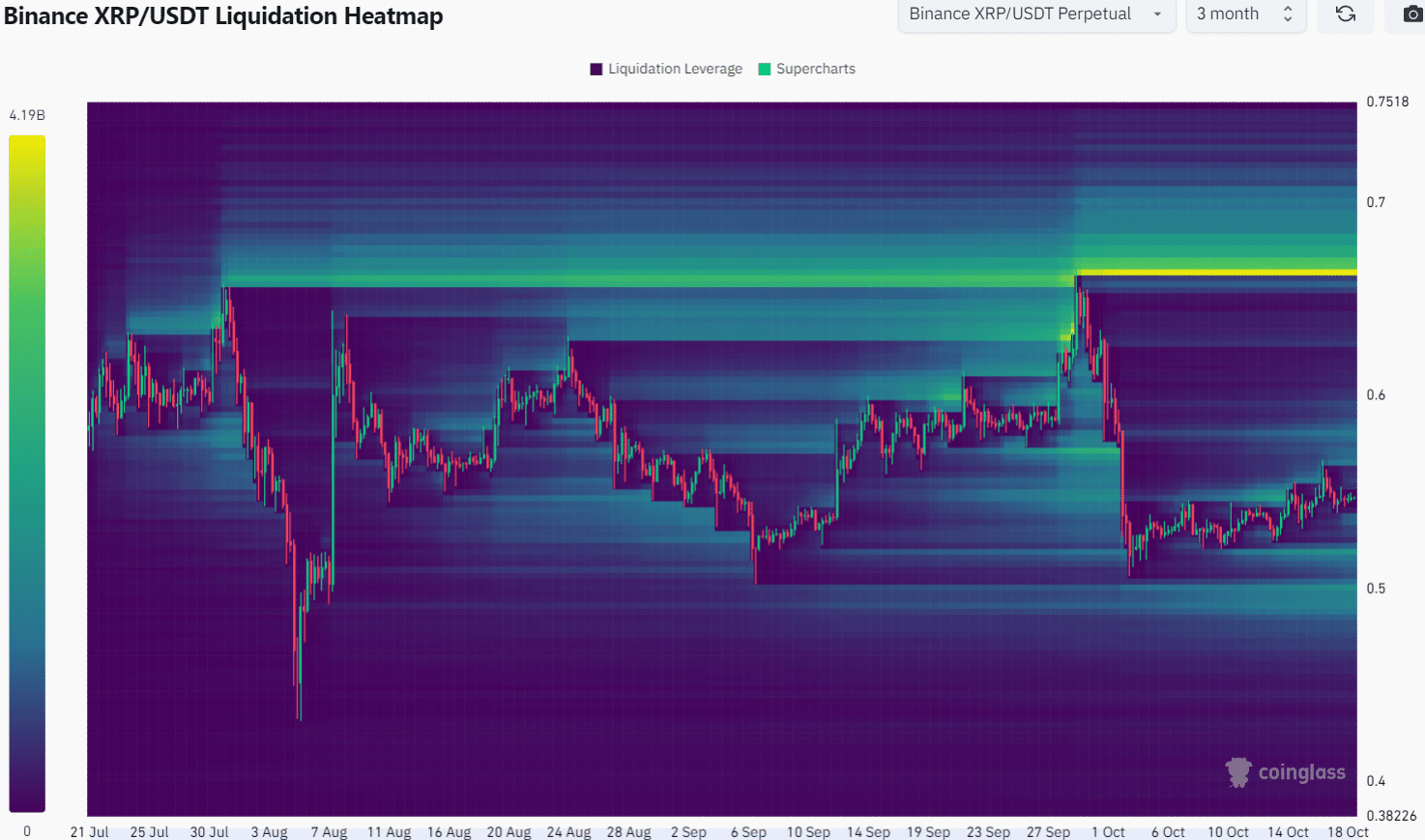

A news event might be required to catalyze a true breakout past the $0.62 resistance. In fact, the 3-month lookback liquidation heatmap revealed that the $0.667 level would be the next target in such a scenario.

Is your portfolio green? Check the Ripple Profit Calculator

Looking at the lower timeframe heatmaps, the $0.52 and $0.57 levels seem to be the nearby magnetic zones that could force short-term price trends to reverse.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Credit: Source link